The Employment Situation is a report by the Bureau of Labor Statistics that gives us a look at the employment outlook of the US economy. The report does not include those employed in agriculture because of the seasonal nature of their work. This report obtains these numbers from 142,000 businesses and government agencies to track the new jobs added in non-farming sectors of the economy.

The Employment Situation is a report by the Bureau of Labor Statistics that gives us a look at the employment outlook of the US economy. The report does not include those employed in agriculture because of the seasonal nature of their work. This report obtains these numbers from 142,000 businesses and government agencies to track the new jobs added in non-farming sectors of the economy.

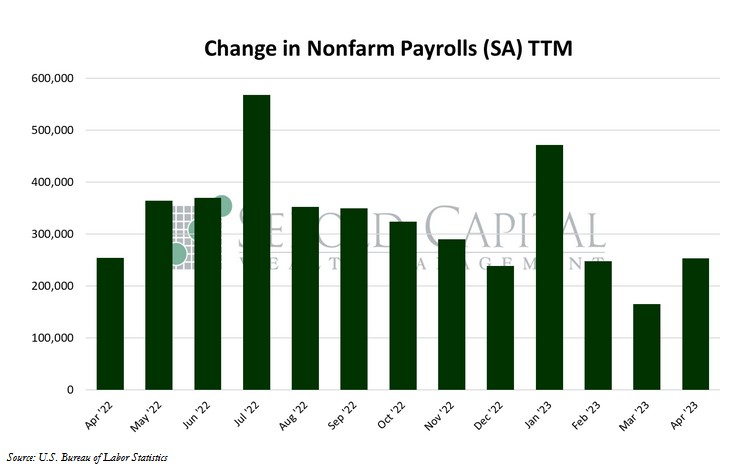

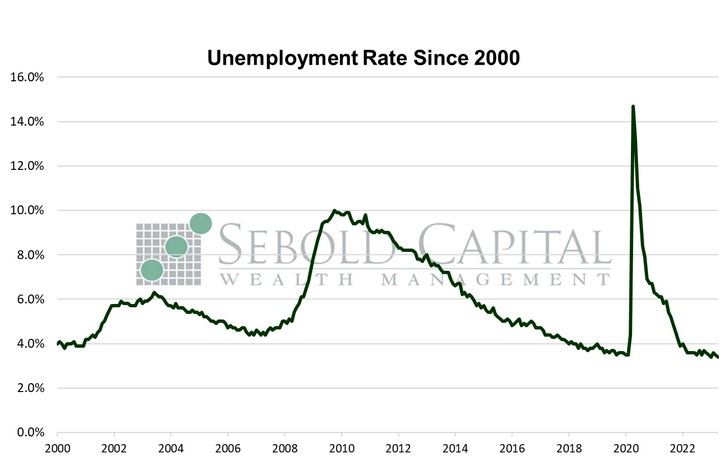

In April, U.S. employment rose by 253,000 on a seasonally adjusted basis, beating market expectations of a 180,000 advance. However, March’s print was revised from 236,000 to 165,000, offsetting some of last month’s increase. The headline unemployment rate declined from 3.5% to 3.4%; it was expected to increase to 3.6%. The average workweek remained unchanged at 34.4 hours. Average hourly earnings rose 0.48% to $33.36, resulting in an annual increase of 4.4%. Average weekly earnings saw an identical 0.48% increase to $1,147.58. The labor force participation rate remained unchanged last month, although there was a decline of 43,000 in the labor force last month. Labor force participation remains below its pre-pandemic level of 63.4%.

Employment numbers were hotter than expected, although this beat should be taken with a grain of salt. While the trend of better-than-expected payrolls numbers continues, the trend of them being revised to the downside does as well. Every print this year has been downwardly revised after its release; January’s stellar jobs number lost 45,000, February’s lost 78,000, and March’s lost 71,000. It is not unreasonable to expect that April’s print will be revised again in the next few months. Until then, the report at least seems to dispel any notion that there might be trouble brewing in the labor market. Despite constant news of layoffs, plenty of industries appear to still be hiring. In fact, the number of individuals unemployed for five weeks or less declined, suggesting that excess labor demand has been enough to absorb at an aggregate level most of the workers who have been laid off. There were strong gains in business services, health care and leisure and hospitality, which were the main drivers of the report.

Resilient labor demand suggests that a recession is not quite here yet. The labor market, however, is a lagging indicator. It is usually the last to fall apart. For now, the labor market does not represent an area of significant concern, although the data certainly does not suggest that further tightening of monetary policy is needed at this time.

May 5, 2023