Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. It shows us where consumers are spending their dollars, whether it be durable and non-durable goods, or on services. Changes in the personal income level usually dictate consumer spending.

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. It shows us where consumers are spending their dollars, whether it be durable and non-durable goods, or on services. Changes in the personal income level usually dictate consumer spending.

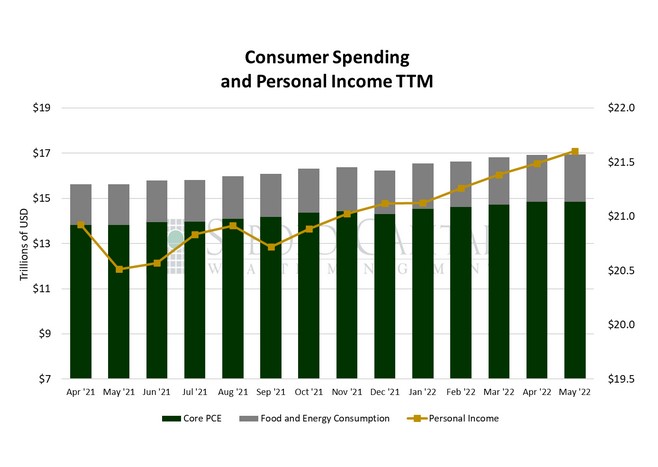

In May, personal consumption rose by 0.19% to $16.96 trillion, while personal income rose by 0.53% to $21.5 trillion. Excluding food and energy, consumption remained unchanged at $14.83. However, both the headline and core prints for April were downwardly revised, yielding a slight net decline. Spending on durable goods fell 3.17% to $2.08 trillion, while spending on non-durable goods rose 0.66% to $3.76 trillion. Spending on services increased 0.69% to $11.12 trillion.

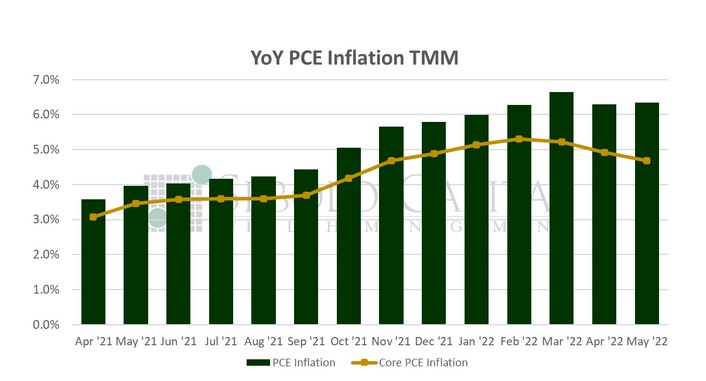

Consumer spending rose last month at the slowest pace of 2022—at least so far. Households continued to face persistently high inflation, which has been eroding their purchasing power for the past several months. Inflation, as measured by the PCE price index, showed little signs of improving last month. The headline print did remain unchanged at 6.3% and it came in below market expectation. However, the month-over-month rate accelerated from 0.2% to 0.6%, suggesting that any perceived moderation was likely the mathematical result of a base effect, rather than the result of prices truly easing. Unsurprisingly, food and energy prices saw the largest increases. This was reflected on the core index, which remained unchanged on a month-over-month basis. While some may celebrate that fact and point to core prices as a sign that inflation may be easing, it is important to remember that consumers must still buy food and energy, regardless of how much their prices rise.

Softening household spending may suggest that a second quarterly decline in GDP is in the cards this year. Inflation has really taken a toll on consumers, particularly in their ability and their willingness to spend. Adjusting for inflation, both personal income and spending declined in May, the first real decline since December. Personal balance sheets remain robust, but consumers are increasingly financing their purchases by saving less. The savings rate fell to its lowest level in more than a decade in April, although it rose moderately in May. While none of this fits the technical definition of a recession, which is determined by the NBER, two consecutive quarters of negative GDP growth would not be great either from an economic perspective.

June 30, 2022