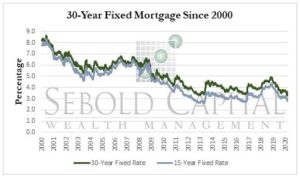

The 30-year fixed mortgage rate is very important to the home-buying market because it accounts for over 80% of financing. The 30-year fixed mortgage is influenced by the 10-year treasury rate of the Federal Reserve when the 10-year treasury rates fall the 30-year mortgage rate fall as well.

The 30-year fixed mortgage rate is very important to the home-buying market because it accounts for over 80% of financing. The 30-year fixed mortgage is influenced by the 10-year treasury rate of the Federal Reserve when the 10-year treasury rates fall the 30-year mortgage rate fall as well.

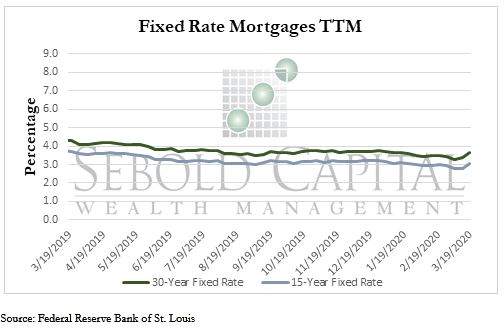

The 30-year fixed mortgage increased to 3.65% in March, compared to 3.49% in February of this year. The 30-year has fallen almost around 15.31% since March of 2019 when the rate was 4.31%. The 15-year fixed mortgage rate has increased from 2.77% to 3.06% at a rate of 2.34% over the past month. However, the yearly 15-year fixed mortgage rate has fallen 18.62% from March 2019, from a rate of 3.76% to 3.06%.

As the 10-year treasury rate continues to fall, so will fixed-rate mortgages eventually. While this is not good when considering the concerns about low future inflation brought about by an economic slowdown, low mortgage rates are great for the housing market. The lower the cost of borrowing for a mortgage, the more potential home buyers might consider buying in the market because of low borrowing costs. The housing market, and consequently, 15 and 30-year mortgages, are very important to sustain economic growth due to how many other sectors real estate can potentially affect. The lowering of the 10-year treasury notes yield, in effect decreasing rates, is most likely due to Investors’ response to the COVID-19 Outbreak and the Federal Reserve once again lowering the rates on March 3, 2020. The short-term uptick in the rates is in response to the immense demand for refinances in the wake of the Federal Reserve response. The market has yet to normalize after the events of the past couple of weeks. In time, they will.

March 20, 2020