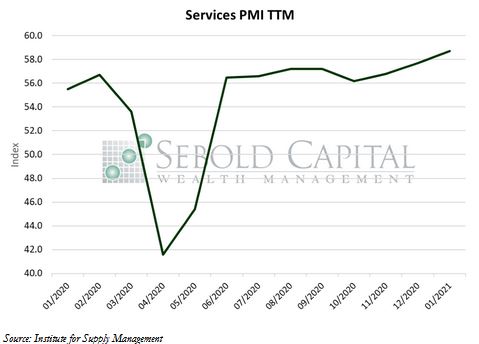

The ISM Services Purchasing Managers Index helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50 indicate expansion while readings below 50 signal decline.

The ISM Services Purchasing Managers Index helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50 indicate expansion while readings below 50 signal decline.

In January, the Services PMI increased by 1.0 percentage point to a level of 58.7%. This represents the eighth consecutive month of growth for the services sector and the highest reading since February 2019. Supplier deliveries sped up last month as indicated by their corresponding index, which registered 57.8% down from 62.8% However, the Business Activity Index fell by 0.6 points to 59.9%. The index that measures prices registered 64.2%, indicating that costs for firms continue to rise.

Out of the 18 industries surveyed, 14 of them reported growth in January. The four exceptions being Arts, Entertainment & Recreation; Educational Services; Retail; and Utilities. Responses about business and economic conditions were more optimistic last month. However, the pandemic-related restrictions continue to negatively impact most industries and keep leading to supply chain challenges. Most respondents report that prices for raw materials and transportation continue to increase, on average by between 4% and 13%. Business conditions are expected to continue to improve throughout the year, especially around Q2 when a large percentage of the population will have already been vaccinated against COVID-19.

February 3, 2021