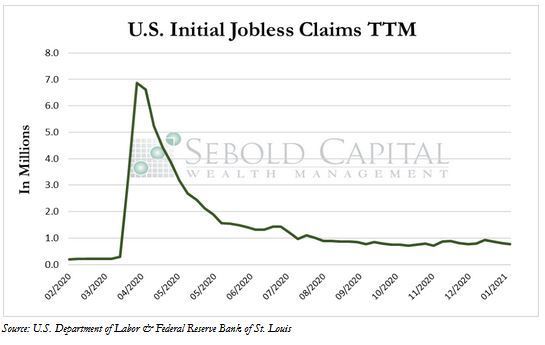

US Initial Jobless Claims, provided by the US Department of Labor, provides underlying data on how many new people have filed for unemployment benefits in the previous week. One can gauge market conditions in the US economy around employment; as more new individuals file for unemployment benefits, fewer individuals in the economy have jobs. In normal times, this means people have less money to spend. Historically, initial jobless claims tended to reach peaks towards the end of recessionary periods, such as on March 21, 2009, when 661,000 new filings were reported.

In the last week of January, initial claims fell by 4.06% to a total of 779,000. This is the third consecutive week in which the number of new unemployment insurance claims filed have decreased. The number of continued unemployment claims also continued to fall, decreasing by 4.03% to 4.59 million. The number of initial unemployment claims remains above the long-run average of about 371,000.

Initial jobless claims were lower than expected last week, and currently sit at their lowest level since November, when new pandemic-related restrictions started being imposed again. As these restrictions have gradually been lifted, unemployment indicators have showed signs of improvement. This has been most noticeable in states that have recently loosened restrictions—such as Illinois, where claims declined by 55,000 last week. Claims are likely to remain elevated for as long as restrictions are still in place and the government continues to provide additional unemployment benefits, which can act as a disincentive for some individuals to return to work.

February 4, 2021