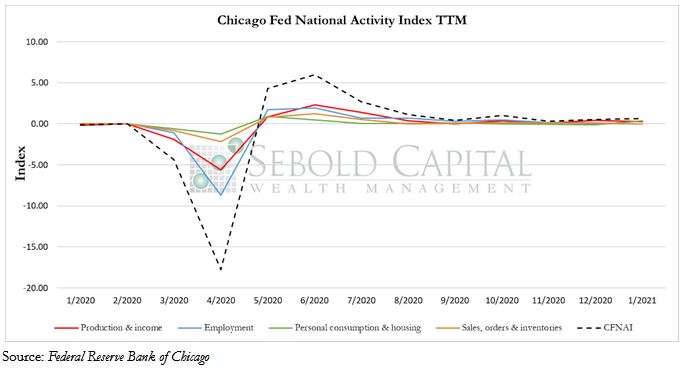

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

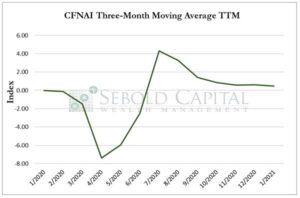

In January, the CFNAI increased by 0.14 points to a level of 0.66. However, the index’s three-month moving average decreased by 0.14 points to 0.47. Three out of the four broad categories of indicators that make up the index decreased last month, but a jump in personal consumption indicators offset those losses. Production and income fell by 0.16 points to 0.28, employment indicators declined by 0.12 points to 0.01, and sales, orders and inventories decreased by 0.03 points to a level of 0.02. Personal consumption saw a boost in January, with the pertinent subindex increasing by 0.44 points to a reading of 0.35.

Last month’s CFNAI reading indicates that the overall economy continues to expand at an above-average rate, compared to historical levels. In contrast to the previous three months, personal consumption was the primary driver of economic expansion in January. The subindex registered a value of 0 in October and had been negative throughout November and December. However, a new round of $600 stimulus checks, combined with many pandemic-related restrictions being eased, boosted spending for the month. Production and income continue to grow above trend, as it has for eight out of the last nine months. The indicators for employment and sales also remain above zero, but only marginally, meaning that they are approaching more historical levels of growth.

February 22, 2021