The ISM Services Purchasing Managers Index helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50 indicate expansion while readings below 50 signal decline.

The ISM Services Purchasing Managers Index helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50 indicate expansion while readings below 50 signal decline.

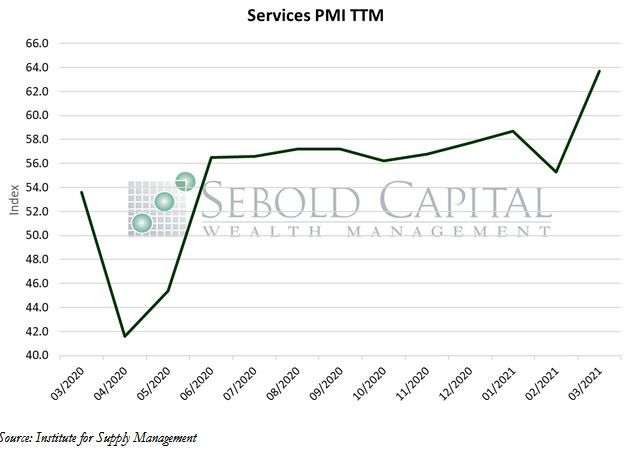

In March, the Services PMI surged by 8.4 points to an all-time high of 63.7. This marks the tenth consecutive month of nationwide growth in the services sector as the index sits well-above 50. Every industry included in the index reported growth last month, highlighting the ongoing expansion in the services sector.

Business activity and production increased at a much faster pace last month as shown by its corresponding index, which registered 69.4. Similarly, the index that measures new orders being placed rose by 15.3 points to 67.2. Inventories fell last month, which is another indicator of rising demand. However, the backlog of orders decreased in March—with the relevant index falling by 5.0 points to 50.2—a sign that businesses are getting better at navigating the supply chain disruptions that have present over the past few months. The employment outlook for the services sector improved last month, with the index rising by 4.5 points to 57.2. March was the first month in quite some time in which labor shortages were not reported by the survey respondents, which serves as a positive sign for the sector. We do not expect this to continue. Despite the overall positive results of last month’s report, rising prices remain a concern. The price index continued to climb in March, rising 2.2 points to 74.0. Every industry reported higher prices, highlighting worries of inflationary pressure building up. In general, respondents of the survey remain optimistic about economic conditions as the remaining restrictions are gradually lifted and things return more or less to normal.

April 5, 2021