Existing Home Sales provide the number of purchases made for homes, condominiums, and co-ops that have already been built, while New Home Sales represent the number of brand-new houses that were purchased or committed to being purchased over the course of a month. Both new and existing home sales give an indication of the demand for housing. When people purchase a home, they buy goods to fill their homes with, lifting other sectors simultaneously. New home sales are also more impactful to GDP than existing home sales since the entire sale value is included instead of only the real estate commission being included for an existing home during the sale. While home resales may not generate new construction jobs as housing starts do, they have a similar effect on consumer spending as people purchase items for their new home.

Existing Home Sales provide the number of purchases made for homes, condominiums, and co-ops that have already been built, while New Home Sales represent the number of brand-new houses that were purchased or committed to being purchased over the course of a month. Both new and existing home sales give an indication of the demand for housing. When people purchase a home, they buy goods to fill their homes with, lifting other sectors simultaneously. New home sales are also more impactful to GDP than existing home sales since the entire sale value is included instead of only the real estate commission being included for an existing home during the sale. While home resales may not generate new construction jobs as housing starts do, they have a similar effect on consumer spending as people purchase items for their new home.

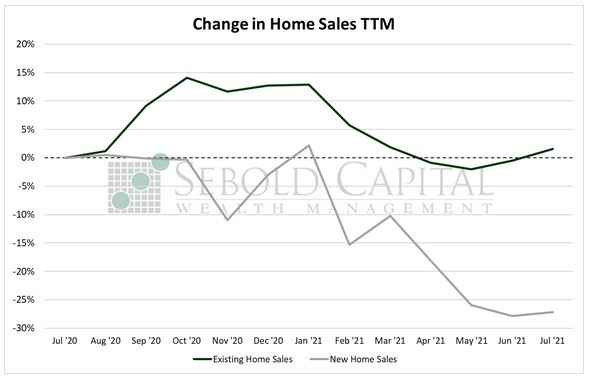

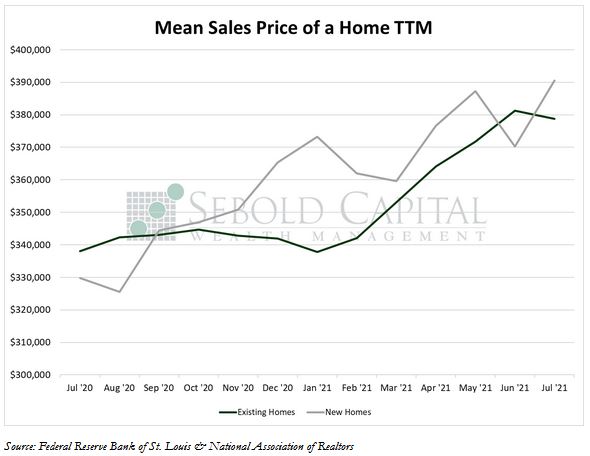

In July, sales of newly built homes rose by 1.0% to 708,000, while sales of existing homes increased by 2.04% to 5.9 million. Housing inventory grew by 7.3% to 1.3 million, although it remains 12.0% below its level from a year ago. However, construction activity slowed down last month, with housing starts declining by 7.0% to 1.5 million. Prices for new homes reached a record-high last month, rising by 5.5% to a mean sales price of $390,500. However, prices for existing homes eased slightly, declining by 0.66% to a mean of $378,700. Mortgage rates declined slightly in July, with the 30-year fixed rate declining from 3.0% to 2.8% over the course of the month, and the 15-year rate falling from 2.3% to 2.1% in the same period.

New home sales were rather mixed last month, despite posting a net gain. On a regional basis, sales of newly built homes declined in two of the four major census regions. Sales plunged in the Northeast, where they fell by 24.1% and in the Midwest, declining by 20.2%. However, sales rose by 14.4% in the West, and they posted a modest gain of 1.3% in the South. On the other hand, existing home sales were more consistent in July. Sales of existing homes posted gains in all four census regions, rising by 4.0% in the Midwest, 3.8% in the West, 1.8% in the South, and 1.6% in the Northeast.

The housing market appears to be showing some early signs that it is cooling off, although plenty of imbalances remain. High prices and a lack of supply have been discouraging potential buyers for several months now. Rising material costs have made it challenging for developers to build enough new homes to alleviate the shortage and has driven up the price of whatever homes are being built. This lack of available homes and the ever-soaring costs have dampened housing demand. While sales rose in July, the pending home sales index declined for the second consecutive month, falling by 8.5% to its lowest level since April. If home prices remain at this level, housing demand will continue to stagnate, which may discourage homebuilders from starting new constructions. However, until housing supply returns to normal levels, prices are unlikely to come down—meaning the housing market might be headed for an impasse.

August 30, 2021