The Employment Situation is a report by the Bureau of Labor Statistics that gives us a look at the employment outlook of the US economy. The report does not include those employed in agriculture because of the seasonal nature of their work. This report obtains these numbers from 142,000 businesses and government agencies to track the new jobs added in non-farming sectors of the economy.

The Employment Situation is a report by the Bureau of Labor Statistics that gives us a look at the employment outlook of the US economy. The report does not include those employed in agriculture because of the seasonal nature of their work. This report obtains these numbers from 142,000 businesses and government agencies to track the new jobs added in non-farming sectors of the economy.

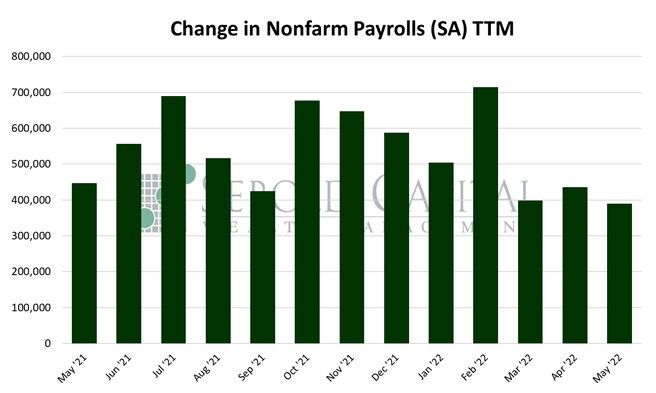

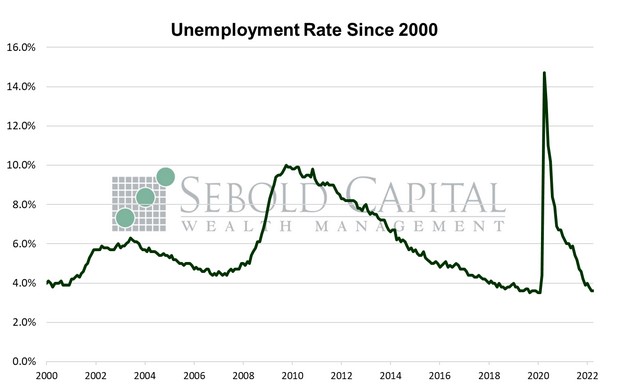

In May, U.S. employment rose by 390,000 on a seasonally adjusted basis, coming in above the market expectations of 328,000. The headline unemployment rate remained unchanged at 3.6%, its lowest value since pre-pandemic levels. The average workweek also remained unchanged at 34.6 hours. Average weekly earnings rose by $3.46 to $1,105.47 and average hourly earnings increased by $0.10 to $31.85. The labor force participation rate increased slightly from 62.2% to 62.3%. About 330,000 people entered the labor force in May, following a decline of 363,000 in April. The labor force participation rate remains below its pre-pandemic level of 63.4%

Employment continued to increase at a solid pace last month, marking the seventeenth consecutive month of job gains for the economy. Although last month’s gain was slightly smaller than April’s print, which was revised from 428,000 to 436,000, it still was high compared to historical levels. For the ten years prior to the beginning of the pandemic, the average monthly gain was around 187,000. The pace of job growth is bound to slow down eventually, it cannot continue at this level forever. The employment level (on a seasonally adjusted basis) is essentially back to where it was prior to March 2020; it is down a mere 0.28% from that point. The unemployment rate is likewise at pre-pandemic levels. The only indicator that continues to lag behind is labor force participation, although that appears to be improving—the data suggests that most of last month’s employment gains came from people returning to the labor force.

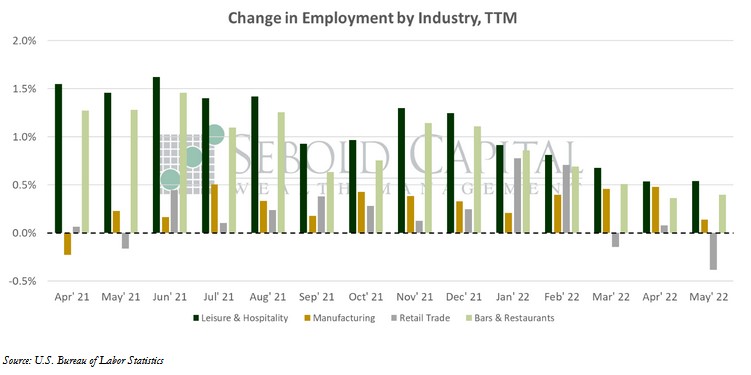

Broken down by sector, employment increased the most in the leisure and hospitality sector, reflecting a continuous shift in consumer demand from goods to services. Leisure and hospitality remains an industry with considerable room for growth, as employment still remains below pre-pandemic levels, despite several months of robust job gains. Other sectors, such as business services, transportation, and warehousing saw solid job growth last month. A robust labor market gives the Federal Reserve some cover to implement a more aggressive—at least as aggressive as this Fed is willing to get—monetary policy. There is already a half-point interest rate hike penciled in for each of the next two FOMC meetings, with the possibility of one more in September. That would put the Fed Funds rate at 2.5% before the end of the year, with plenty of room to the upside remaining. No wonder the market gets spooked every time a solid jobs number comes out.

June 3, 2022