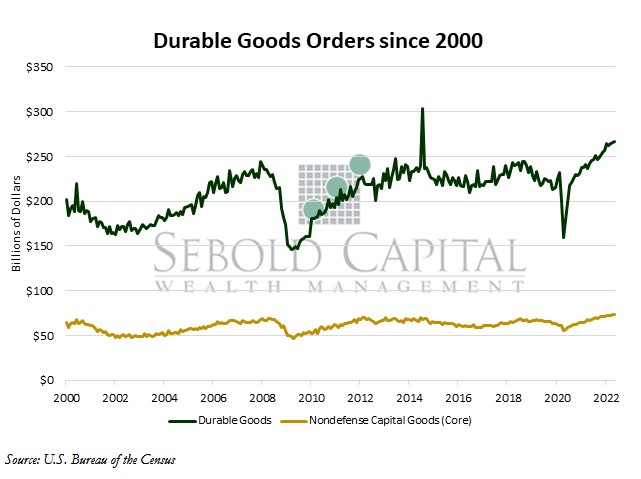

Durable goods orders, which are orders to buy products that are expected to last at least three years, indicate how busy factories will be. As the name suggests, durable orders provide a look into demand for equipment along with other big-ticket purchases, such as vehicles and appliances. An increase in capital spending and consumer purchases indicates an increase in business investment and personal consumption in GDP.

Durable goods orders, which are orders to buy products that are expected to last at least three years, indicate how busy factories will be. As the name suggests, durable orders provide a look into demand for equipment along with other big-ticket purchases, such as vehicles and appliances. An increase in capital spending and consumer purchases indicates an increase in business investment and personal consumption in GDP.

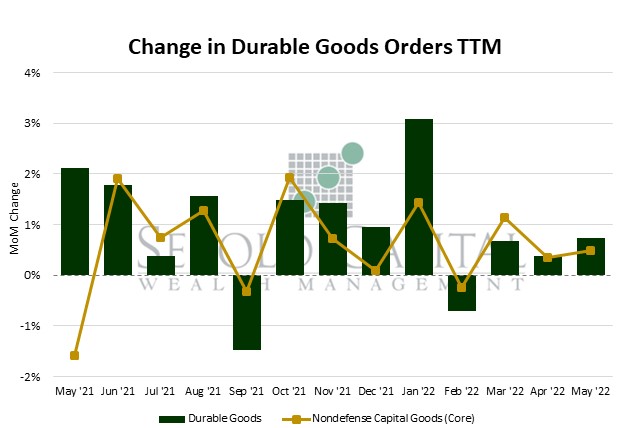

In May, orders for durable goods rose by 0.7% to $267.2 billion, beating market expectations of a 0.3% decline by a considerable margin. Orders for nondefense capital goods rose by 0.5% to $83.7 billion, likewise beating market forecasts. Core capital goods, which also exclude aircraft orders, saw an increase of 0.5%, totaling $73.5 billion in orders for the month.

Orders for long-lasting goods accelerated last month, defying market expectations of a decline and suggesting that economic conditions are perhaps more robust than other indicators are suggesting. May’s durable goods print, which corresponds to the investment component of GDP, suggests that firms continue to be willing to spend and invest in new equipment, even as prices and borrowing costs rise. This is a positive sign, as there are concerns that the Fed’s current tightening cycle might slow down the economy enough to cause a recession. However, there is little evidence at this time that suggests that higher interest rates are cooling the overall business environment; compared to the previous month, spending by firms accelerated. That said, investment makes up a relatively small portion of gross domestic product, especially when compared to spending by consumers, so consumption indicators must be given greater weight when analyzing economic conditions. The latter shows that economic growth is slowing, which is to be expected as that is the intention of current monetary policy actions. The extent of the slowdown remains to be determined, although we do not appear to be in a full-blown recession—yet.

.

June 27, 2022