The Employment Situation is a report by the Bureau of Labor Statistics that gives us a look at the employment outlook of the US economy. The report does not include those employed in agriculture because of the seasonal nature of their work. This report obtains these numbers from 142,000 businesses and government agencies to track the new jobs added in non-farming sectors of the economy.

The Employment Situation is a report by the Bureau of Labor Statistics that gives us a look at the employment outlook of the US economy. The report does not include those employed in agriculture because of the seasonal nature of their work. This report obtains these numbers from 142,000 businesses and government agencies to track the new jobs added in non-farming sectors of the economy.

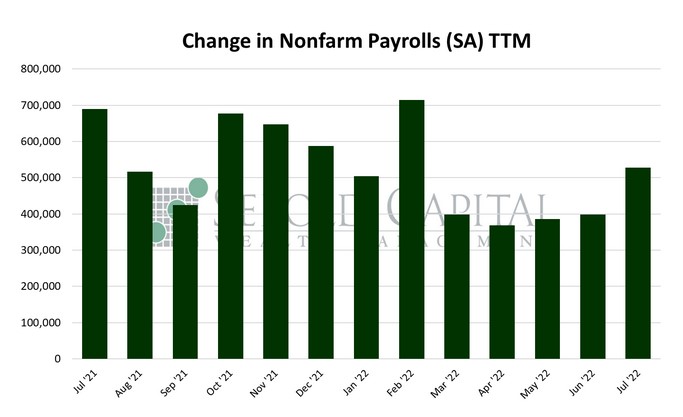

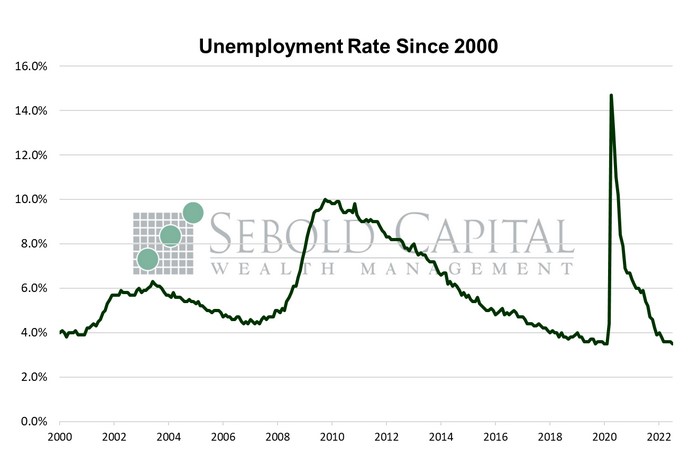

In July, U.S. employment rose by 528,000 on a seasonally adjusted basis, coming in considerably above market expectations of a 240,000 advance. The June print was also revised to the upside, from 372,000 to 398,000. The headline unemployment rate declined for the first time in five months, falling from 3.6% to 3.5%. The average workweek remained unchanged at 34.6 hours—the same value that has been reported since February. Average hourly earnings rose modestly, increasing from $32.12 to $32.27, while average weekly earnings increased from $1,111.35 to $1,116.54. However, the labor force participation rate declined for the third consecutive month, falling from 62.2% to 62.1%—the lowest value since December and a far cry from its pre-pandemic level of 63.4%,

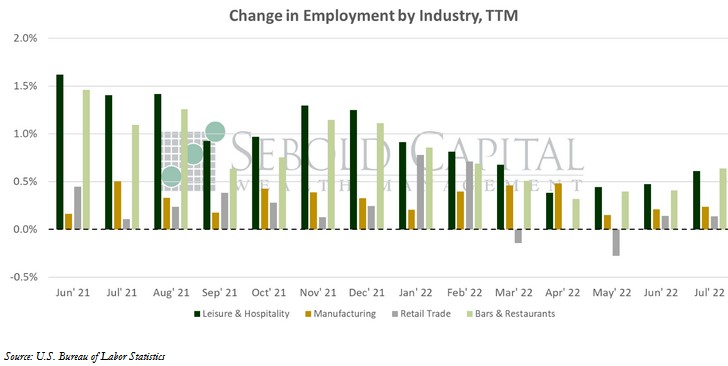

The labor market saw a significant increase in payrolls last month, defying expectations of slower job growth and the indicators that suggested it. While indicators such as unemployment insurance claims, total job openings, and certain private-sector employment indexes seemed to imply that labor demand was softening, the economy added the most payrolls since February. With the unexpected increase in payrolls, all the employment losses caused by the pandemic (and the subsequent measures that attempted to contain it) have finally been erased—although the employment level technically remains below its February 2020 level. After this point, we can finally accurately say that jobs are being created, not just recovered. However, one indicator that has certainly not recovered is labor force participation. Another 63,000 people left the labor force last month, adding to the loss of 353,000 suffered in June. The labor force shrank to its smallest level since January, casting a shadow on all the shiny payroll growth.

One more shadow looming over the labor market, and over the economy as a whole, is inflation. While wages have been increasing at a historically high pace, so have prices. Workers in aggregate saw a 0.5% pay increase in July; after adjusting for inflation, they saw a 0.8% pay cut. Inflation, coupled with a labor market that seemingly refuses to cool down, paves the way for the Fed to continue increasing interest rates. That helps explain why, despite a stellar employment report with widespread job gains across industries, markets are nervous. On a more positive note, a robust jobs report like this one appears to indicate that recession fears are being overplayed; the NBER is not going to declare a recession while the labor market, one the key indicators they take into account when making the official determination, remains at full employment.

August 5, 2022