Retail Sales are the total amount of merchandise and related services sold to consumers. It is considered a sign of strength of U.S. Consumer spending, which accounts for roughly two-thirds of the economy. This indicator also provides insight into which areas of the retail space are experiencing strong sales.

Retail Sales are the total amount of merchandise and related services sold to consumers. It is considered a sign of strength of U.S. Consumer spending, which accounts for roughly two-thirds of the economy. This indicator also provides insight into which areas of the retail space are experiencing strong sales.

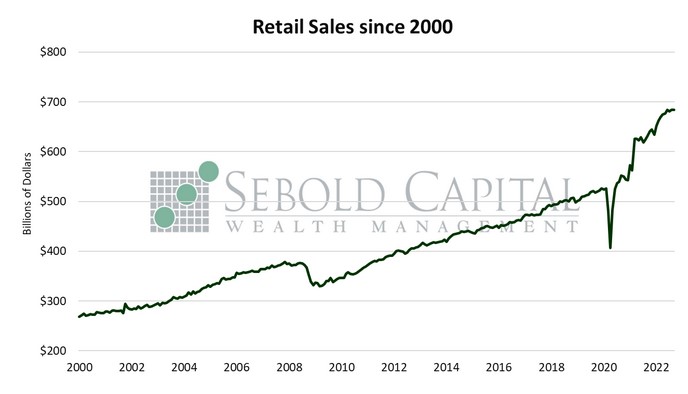

In September, retail sales remained essentially unchanged at $684.0 billion, missing estimates of a 0.2% advance. However, August’s print saw a very slight revision to the upside, from 0.3% to 0.4%. Excluding auto sales, spending rose 0.1%, beating the consensus of -0.1%. Two of the four broad categories that make up the report saw higher sales last month. Spending at bars and restaurants rose by 0.5% to $87.2 billion, as did sales of clothing and apparel, the latter increasing to $26.2 billion. However, sales at electronics and appliance stores posted their fifth consecutive monthly decline, falling 0.8% to $7.4 billion. Sales at sporting goods and hobby stores declined 0.7% to $9.2 billion, breaking a seven-month-long streak of positive prints.

Consumer spending remained largely flat at an aggregate level last month, meaning that in real terms, it declined. Using the headline CPI to adjust the monthly print yields a 0.4% decline. On an annual basis, inflation-adjusted retail sales were unchanged relative to September 2021. Part of the decline can be attributed to lower gas prices; sales at gas stations fell last month, implying lower prices, and core retail sales ex-gasoline came in better than expected. The so-called “control group,” which excludes several categories and is usually seen as a more accurate proxy for the consumer spending component of GDP, also came in better that expected. Overall, the report sends mixed signals—not unlike most economic indicators that have been released recently. The headline numbers generally do not look too great, but the underlying reports seem to indicate that the economy may be more resilient than perhaps many give it credit for.

October 17,2022