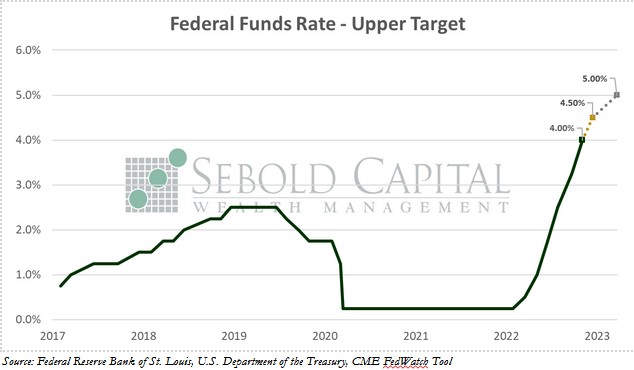

During its latest meeting, the FOMC delivered its fourth 75 basis-point interest rate hike, and the sixth rate hike of any size so far this year. This lifted the target federal funds rate to a range between 3.75% and 4.0%, right in line with market expectations. The market is currently pricing in a smaller half-point hike in December, bringing the Fed Funds rate to 4.5% by the end of the year, and another half-point hike early in 2023. The target rate is expected to reach 5% in March of next year.

During its latest meeting, the FOMC delivered its fourth 75 basis-point interest rate hike, and the sixth rate hike of any size so far this year. This lifted the target federal funds rate to a range between 3.75% and 4.0%, right in line with market expectations. The market is currently pricing in a smaller half-point hike in December, bringing the Fed Funds rate to 4.5% by the end of the year, and another half-point hike early in 2023. The target rate is expected to reach 5% in March of next year.

While no one was surprised by the size of the hike—it had been priced in for weeks—Powell’s remarks pulled the rug from under the markets right as they began to see the light at the end of the tunnel. The Chairman stated that, while it may soon become appropriate to slow down the pace of the interest rate increases, the Fed will likely have to raise rates to a higher level than anticipated. His rationale for the latter remains anyone’s guess, or at least it should for anyone who has actually seen recent data. Inflation has largely moderated, especially when looking at commodities. Let’s not forget that energy prices were one of, if not the, primary drivers of inflationary pressures earlier this year. Domestic demand is slowing, as evidenced by the latest GDP report. The headline was stronger than expected, but it showed consumption slowing down. The report also showed inflation slowing down drastically relative to the previous quarter, at least as measured by the GDP deflator. Higher interest rates are also having a significant impact on housing, especially in the construction of new homes.

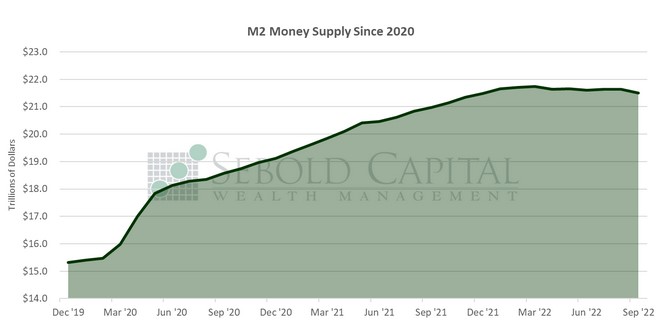

Yet again, there was little mention about the money supply, with nearly all the focus remaining on interest rates. The latest M2 print was released a week before the meeting, and it showed growth in the money supply flattening even further; it fell by 0.6% in September. If the goal is to bring the inflation rate back to 2%, M2 indicates we should be in good shape. Given that there is generally a lag between change in M2 and an increase in inflation, the recent trends in the direction of M2 should be enough to create disinflation without the Fed needing to overtighten. Now, the money supply remains nearly 40% above its pre-2020 levels, so some increase in rates is appropriate, but its direction remains more important.

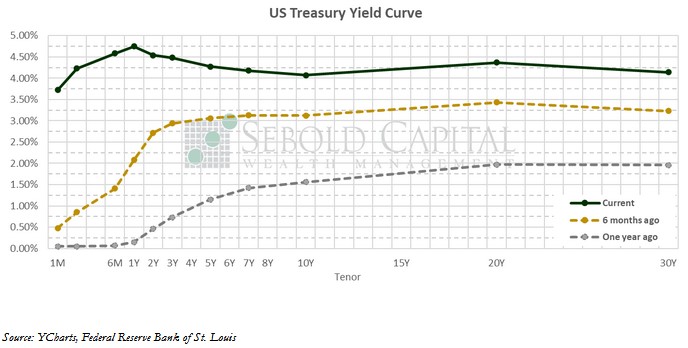

The market has increased its pessimism on the Fed delivering a soft landing. The inverted yield curve continues to price in interest rate declines in the out years, how far out that will be remains the question of the day. We still maintain that the current rate hikes are already having a cooling effect on the economy. The full weight of these hikes, however, we have not yet seen. There are “long and variable lags” in inflation data. We are accustomed to seeing immediate impacts from Federal Reserve actions, inflation is a battleship that needs 12 months to see what happened. Chairman Powell does not want to wait that long to find out if he is right or wrong.

The market has increased its pessimism on the Fed delivering a soft landing. The inverted yield curve continues to price in interest rate declines in the out years, how far out that will be remains the question of the day. We still maintain that the current rate hikes are already having a cooling effect on the economy. The full weight of these hikes, however, we have not yet seen. There are “long and variable lags” in inflation data. We are accustomed to seeing immediate impacts from Federal Reserve actions, inflation is a battleship that needs 12 months to see what happened. Chairman Powell does not want to wait that long to find out if he is right or wrong.

November 3, 2022