Retail Sales are the total amount of merchandise and related services sold to consumers. It is considered a sign of strength of U.S. Consumer spending, which accounts for roughly two-thirds of the economy. This indicator also provides insight into which areas of the retail space are experiencing strong sales.

Retail Sales are the total amount of merchandise and related services sold to consumers. It is considered a sign of strength of U.S. Consumer spending, which accounts for roughly two-thirds of the economy. This indicator also provides insight into which areas of the retail space are experiencing strong sales.

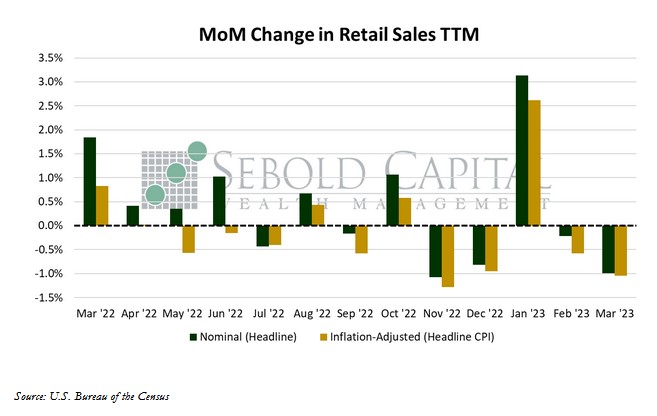

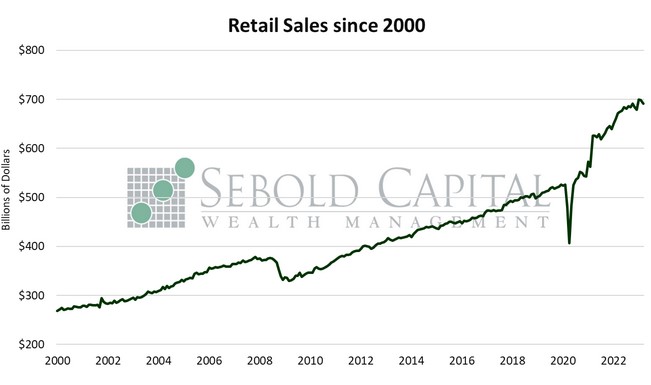

In March, retail sales declined to $691.7 billion, coming in below the expectation of a 0.4% decline. February’s print was revised to the upside, although it remained negative at -0.2%. Excluding auto sales, retail sales fared marginally better, declining by 0.8% (the headline print was -1.0%). Two of the four broad categories that make up the report saw higher sales last month. Spending at bars at restaurants increased by 0.1% to $93.1 billion, while purchases at hobby and bookstores rose 0.2%. However, those marginal increases were offset by a 1.7% decline in clothing sales, and by a 2.1% drop in spending at electronics and appliance stores.

Consumer spending appeared to weaken at an aggregate level last month. Sales at gas stations were the greatest contributors to the decline by far; that was mainly the result of a drop in gas prices in March, which have since rebounded strongly. There were also significant drops in sales of motor vehicles, furniture, clothing, food, and electronics. The so-called “control group,” which excludes several categories and is a good proxy for the consumer spending component of GDP, also had a negative print last month—although it came in slightly better than expected. It is always important to note that none of these numbers are adjusted for inflation, although the last inflation print—a very moderate 0.05%—had little impact on the real number last month. Year-over-year, inflation-adjusted retail sales are down 2.0% (compared to a 2.9% nominal print), the most since mid-2020. Overall, it is evident that consumer demand is beginning to soften, although not to an extent that is too concerning yet. Any sign of cooling demand is a welcome one from a monetary policy perspective; consumer demand has remained notably resilient even as the Fed aggressively hiked rates. Moderating consumer demand, especially accounting for the usual lag in monetary policy, is perhaps a signal that continuing to raise interest rates is likely not necessary. Bad news continues to be good news.

April 14, 2023