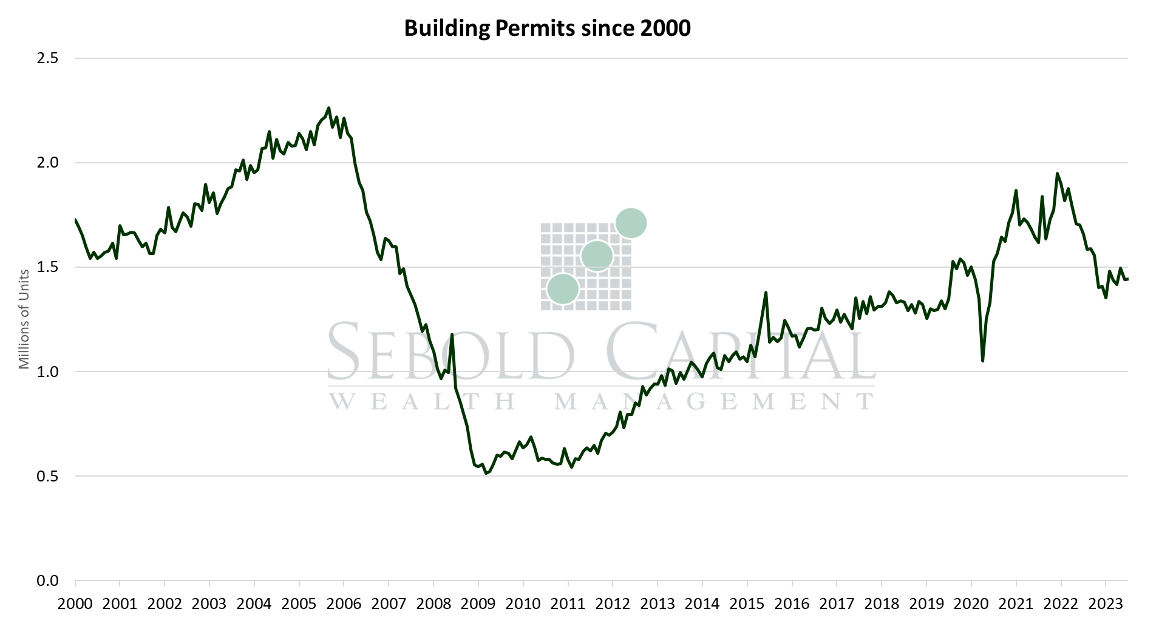

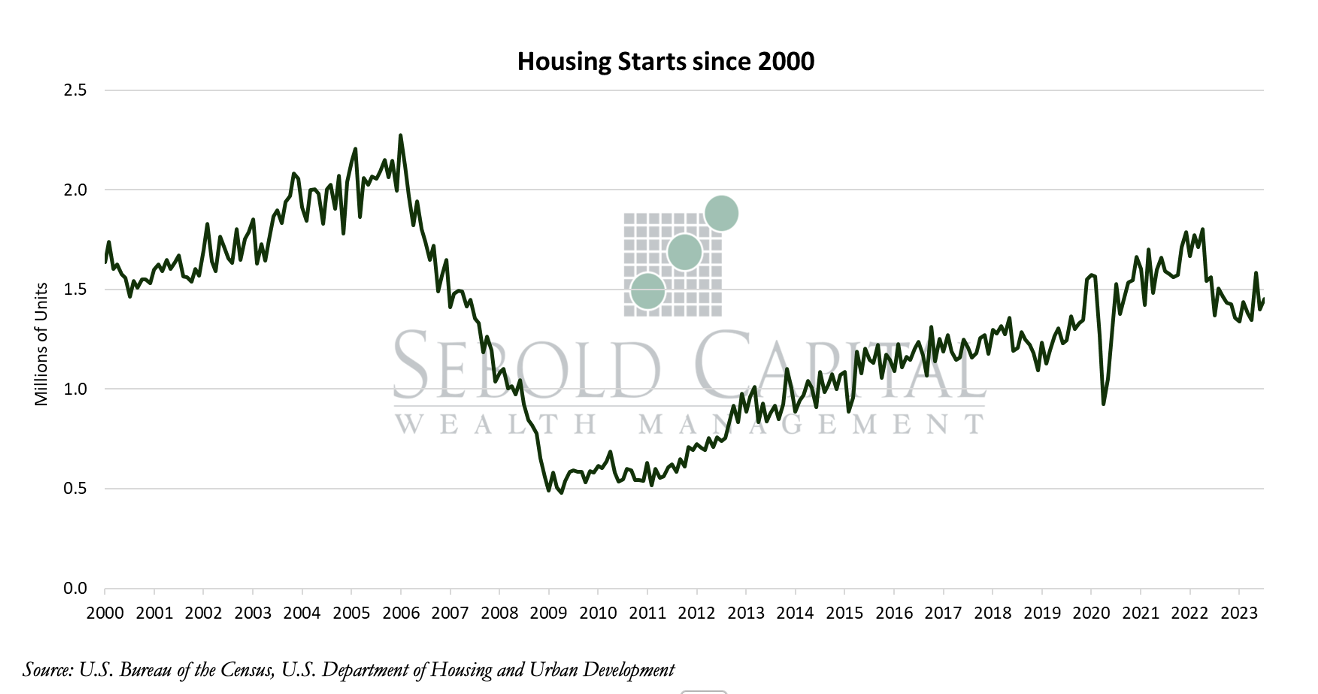

U.S. Building Permits refer to the approvals given by local jurisdictions prior to the construction of new real estate developments. Housing starts track the number of new residential construction projects that have begun over the last month. Both of these indicate the demand in construction spending and jobs, consumer wages, and complementary sectors such as durable household item sales. Building Permits and Housing Starts are both considered to be leading economic indicators.

In July, building permits saw a moderate increase of 0.1%, rising to a seasonally adjusted annual rate of 1.44 million. However, permits are down 13.0% relative to the previous year. Housing starts rose by 3.9% to 1.45 million, coming in above the expected 1.7% increase. June’s print saw a significant revision from -8.0% to -11.7%, losing some steam after May’s stellar 17.4% increase in new homes being built.

Housing is the single largest component of both the CPI and PCE, explaining why these indices have remained elevated despite many of their other components seeing declines. There is also, however, a significant lag between real housing data and the government’s estimation of shelter costs. Inflation data does not always line up with our expectations.

Prior to early 2022, when the Fed first began hiking rates, mortgage rates were at record lows. Unsurprisingly, many took advantage of the situation and either refinanced their existing mortgage or bought a new home. Today, the majority of homeowners find themselves with a mortgage rate that is well below current market rates. Current homeowners are not eager to trade their 3% rate for 7% or even 8% mortgage rate. As a result, people are taking a good hard look at staying in their current home before looking at buying a new property with a new mortgage rate.

Homebuilding picked up in 2021 after a drop in 2020 but slowed down again in 2022 as borrowing costs began to increase and labor and materials were scarce. This has led to a significant increase in the price of new homes as well. Renting in this environment is not a much better option either. Rental properties are usually financed through commercial loans, which typically have a five-to-seven-year maturity. Anything that is refinanced at today’s rates will be significantly more expensive, which will translate to higher rents. All of this feeds into the most common inflation measures, distorting the picture of what is actually going on in the economy. It would seem that stubbornly high inflation would call for more rate hikes, but ironically, higher rates would only exacerbate the issue—getting rid of a cheap mortgage looks increasingly less attractive, mortgage payments soar, the supply of housing remains constrained, and prices stay elevated.