Housing starts track the number of new residential construction projects underway over the course of a month. This indicator has implications for demand in construction spending/jobs, consumer wages, and complimentary sectors such as durable household item sales. Along with building permits, housing starts is considered a leading economic indicator.

Housing starts track the number of new residential construction projects underway over the course of a month. This indicator has implications for demand in construction spending/jobs, consumer wages, and complimentary sectors such as durable household item sales. Along with building permits, housing starts is considered a leading economic indicator.

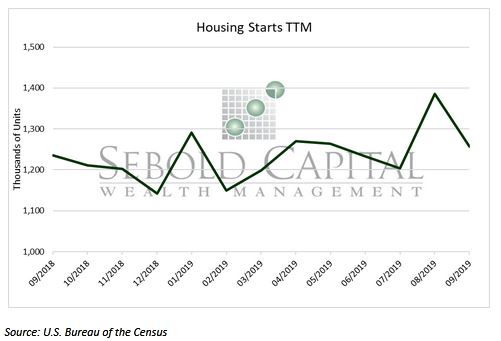

Housing starts fell in September by 9.4% to an annualized rate of 1.256 million after a high in August. This drop happened due to a drop of 28.2% in the volatile multi-family starts. Single-family starts were up .3%. Building permits dropped by 2.7%, but again, this can be attributed to a drop in multi-family homes, as single-family permits rose by .8%.

Since every single-family home contributes twice as much to the GDP as a multi-family one, this shift toward single-family homes suggests a growing U.S. economy moving forward. Housing will continue to increase, considering current low mortgage rates as well as quick wage growth. Therefore, the U.S. economy should see sustainable growth. Housing starts have not reached the same level that they were at prior to 2006 because many millennials have student loan debt, with average monthly payments at $393 and average interest rates at 4.45 to 7%. Many millennials also stay with their parents or prefer to move to metropolitan areas in their youth as opposed to suburban or rural areas with more potential for new housing development.

October 17, 2019