The Effective Federal Funds Rate is the interest rate at which banks trade federal funds with each other. This rate is determined by the Federal Open Market Committee. The Federal Funds Rate influences the interest rates at which banks and credit card companies charge customers.

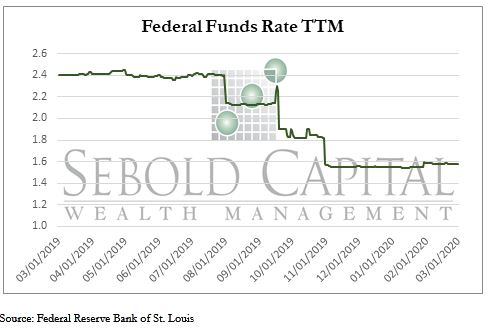

As of March 1st, Federal Funds were 1.6%, a decrease from last year’s rate of 2.4%. The Federal Funds Rate has also further decreased as of March 4th to 1.1%.

Despite climbing interest rates over the past year, the Federal Reserve decided after their March 3rd meeting to lower the Federal Funds rate by .25%; hinting at possibly another .25% rate to stimulate the US economy if begins to show signs of weakness. There was an additional emergency cut on March 16th by 1%, reducing rate to a range of 0-0.25%, historically low rates, as an attempt to stimulate the economy as the COVID-19 outbreak has caused a major economic slowdown.

March 16, 2020