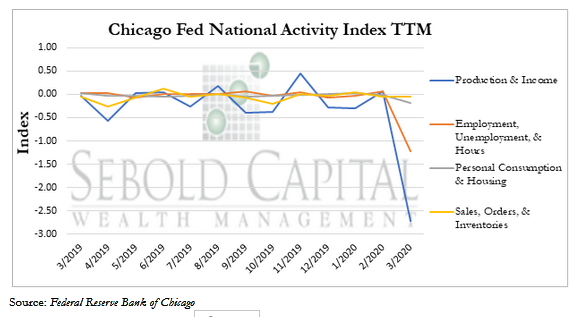

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

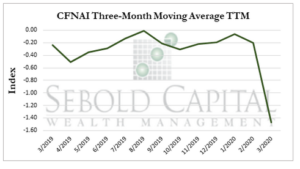

The CFNAI fell by -4.25 points from a level of 0.06 in February to -4.19 in March. The index’s three-month moving average decreased -1.47 in March, the lowest since 2009, from -0.20 in February. All four broad categories fell in March with Production & Income and Employment, Unemployment, & Hours leading this decline both falling by -2.78 and -1.30 points to readings of -2.72 and -1.23.

The Chicago Fed National Activity Index declined in March to a level that indicates that the U.S has slipped into a recession, primarily lead by weaker employment and production indicators that have been severely impacted by the coronavirus pandemic. This can be shown by the three-month moving average falling below -0.70, which has historically been associated with the increasing likelihood of a recession.

April 20, 2020