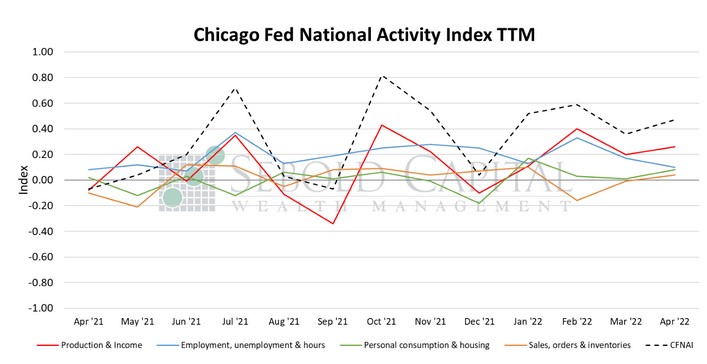

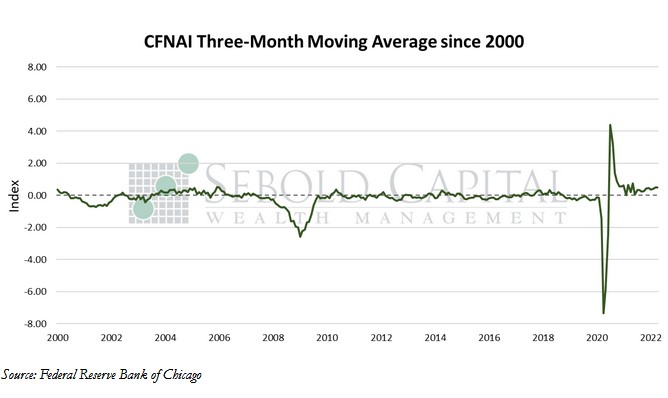

The Chicago Fed National Activity Index (CFNAI) is an indicator designed to gauge overall economic activity and related inflationary pressure. It is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. The index is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

The Chicago Fed National Activity Index (CFNAI) is an indicator designed to gauge overall economic activity and related inflationary pressure. It is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. The index is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

In April, the CFNAI rose by 0.11 points to an index level of 0.47. However, the index’s three-month moving average declined by 0.01 points to a reading of 0.48. Three out of the four broad indicators that make up the index rose last month, and they all had positive contributions to the CFNAI. Employment indicators fell by 0.07 points to a level of 0.10, while the subindex that measures sales and orders rose by 0.05 points to a reading of 0.04, breaking a two-month negative streak. Production and income indicators increased by 0.06 points to a level of 0.26. Personal consumption and housing indicators advanced by 0.07 points to a reading of 0.08.

Economic activity gained some momentum last month, increasing at a slightly faster pace in relation to the previous month. The CFNAI print came in above market expectations, which hovered at around 0.35. The apparent increase in economic activity in April should provide some relief to those concerned about a potential economic downturn, whether that might be caused by factors like inflation or the Federal Reserve’s response to it. The Fed hiked interest rates back in March, raising them by 25 basis points. So far, the overall economy seems to be responding relatively well to the change in policy, excluding perhaps the housing and stock markets. Now, it remains to be seen how the economy will respond to May’s rate hike, which was double that of March, or how it will respond to any subsequent rate hikes. However, at first glance, it appears that economic conditions remain relatively robust, meaning that a soft landing may not be as elusive as previously thought.

May 24, 2022