The Chicago Fed National Activity Index (CFNAI) is an indicator designed to gauge overall economic activity and related inflationary pressure. It is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. The index is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

The Chicago Fed National Activity Index (CFNAI) is an indicator designed to gauge overall economic activity and related inflationary pressure. It is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. The index is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

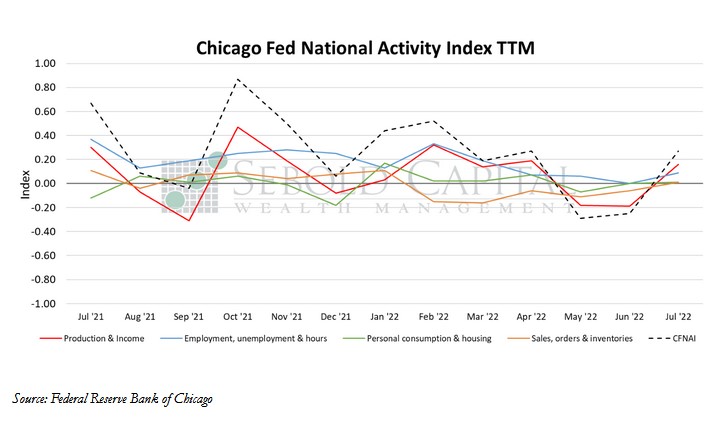

In July, the CFNAI by 0.52 points to an index level of 0.27, breaking a two-month streak of negative index values and beating market expectations of a -0.02 print. The index’s three-month moving average remained unchanged last month. All four broad indicators that make up the index rose in July, and they all had positive contributions to the CFNAI. Production and income indicator saw a notable 0.35-point increase to a level of 0.16, likewise breaking a two-month streak of below-trend economic growth. Employment indicators increased from an index level of zero to a print of 0.09, while personal consumption indicators remained nearly unchanged increasing by 0.01 points, also from zero. The sub-index that measures sales, orders, and inventories saw its first positive value since February, rising by 0.07 points to a level of 0.01.

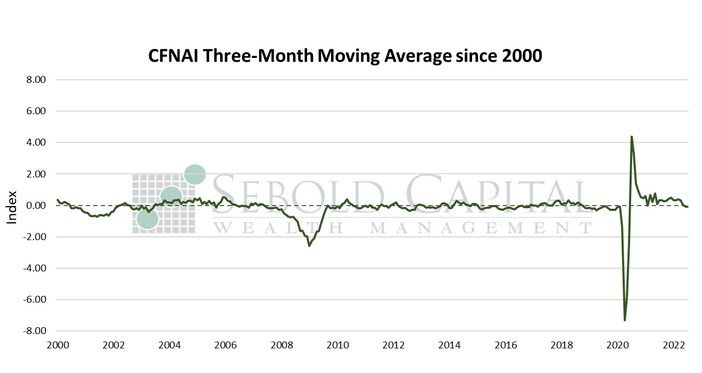

Last month, economic activity regained some of the momentum it had lost since May, resuming growth at a pace above its trend. In an ocean of economic indicators sending mixed signals, July’s CFNAI print provides a more positive outlook for the economy. Production and income indicators improved considerably, as did sales activity. Employment indicators rose from a neutral value, coinciding with a robust nonfarm payrolls report and a slightly lower unemployment rate. Personal consumption and housing indicators remain near neutral levels, but that is still an improvement over their negative contribution two months ago. The diffusion index remained negative, but its -0.05 continues to be above the key value of -0.35; readings above that value have historically been associated with periods of economic expansion. The CFNAI indicates that economic conditions remain relatively favorable, although the accelerated pace of economic growth observed as the economy began to reopen is likely over.

August 23, 2022