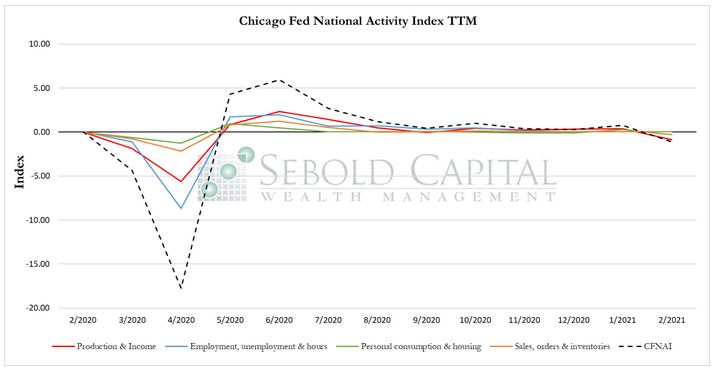

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

In February, the CFNAI decreased by 1.84 points to a level of -1.09, the index’s first negative reading since last April. The index’s three-month moving average decreased by 0.48 points to -0.2. All of the four broad categories of indicators that make up the index decreased last month. Production and income declined by 1.22 points to a level of -0.85. Personal consumption and housing fell by 0.56 points to a reading of -0.29. Only two indexes remained in positive territory last month. The index that measures employment decreased by 0.2 points to a level of 0.2, while the index measuring sales, orders, and inventories declined by 0.3 points to a reading of 0.3.

Last month, the economy expanded at a below-average trend for the first time in almost a year. The decline was driven mainly by a slowdown in production-related indicators, which were impacted by the severe winter weather observed throughout February. While employment and sales remained positive, their marginal contributions were not enough to offset the decline in the other categories. Economic growth is expected to accelerate in the upcoming months as the vaccine rollout becomes more widespread and the remaining restrictions on businesses are lifted. The diffusion index fell to 0.17 in February but remains above the -0.35 level that has been traditionally linked to periods of economic expansion. Likewise, the CFNAI’s three-month moving average remains above -0.70, which is another historical indicator of possible economic growth.

March 22, 2021