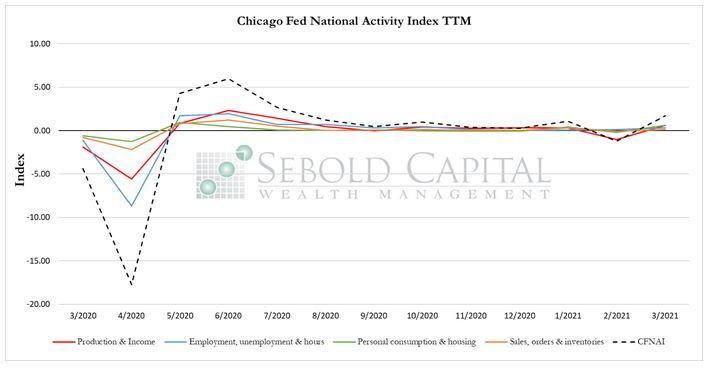

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

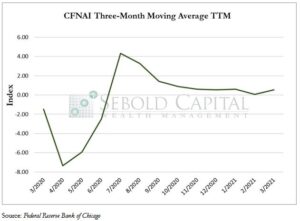

In March, the CFNAI rose by 2.91 points to an eight-month high of 1.71. The index’s three-month moving average increased by 0.47 points to a reading of 0.54. All of the four broad categories of indicators that make up the index improved last month. Production and income increased by 1.67 points to a value of 0.63. Employment indicators rose by 0.22 points last month to a reading of 0.34. The subindex that measures personal consumption likewise increased to a value of 0.63, 0.84 points higher than the previous month’s reading. Sales, orders, and inventories rose by 0.17 points to a reading of 0.11.

Last month, the economy resumed its expansion at an above-average rate after a brief slump in February, when the CFNAI registered its first negative reading in almost a year. The current CFNAI reading coincides with the economic improvement shown by other indicators, such as retail sales and payroll creation—both of which also posted strong growth in March. Economic activity is likely to accelerate—at least in the near term—as more people are vaccinated, the remaining restrictions are lifted, and fiscal stimulus seeps through the economy. The CFNAI diffusion index mirrors these expectations, rising from 0.22 to 0.40 last month. A diffusion index reading above -0.35 has been generally associated with periods of economic growth.

April 22, 2021