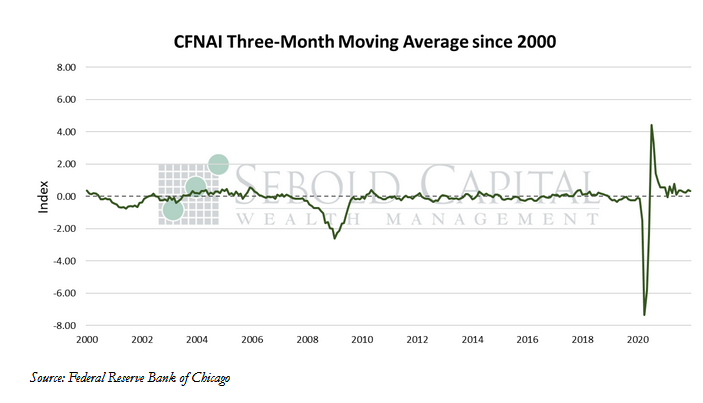

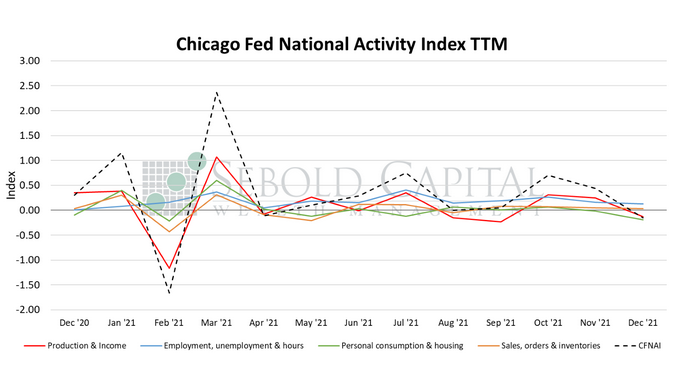

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

The Chicago Fed National Activity Index (CFNAI) is a weighted average of 85 existing monthly indicators of national economic activity that are divided into four broad categories of data: production & income; employment, unemployment, & hours; personal consumption & housing; and sales, orders, & inventories. It is constructed to have an average value of zero and a standard deviation of one. Since economic activity tends toward trend growth rate over time, a positive index reading corresponds to growth above trend, and a negative index reading corresponds to growth below trend.

In December, the CFNAI declined by 0.59 points to an index level of -0.15. The index’s three-month moving average declined from 0.40 to a reading of 0.33. All of the four broad indicators that make up the index declined last month. Production and income indicators fell by 0.38 to an index level of -0.13. The sub-index that measures personal consumption and housing declined by 0.17 points to a reading of -0.19. Employment indicators fell by 0.03 points to a level of 0.13 and indicators that measure sales, orders, and inventories retreated 0.02 points to a reading of 0.03.

Economic growth declined in December for the first time in eight months as rising prices and supply-chain bottlenecks continued to weigh on firms and consumers. The index came in significantly below expectations, which hovered at a level of 0.49. Production and consumption indicators saw the largest declines, both slipping into negative territory. Factories have been struggling with supply-chain disruptions and worker absenteeism, leading to less production and lower capacity utilization. Personal consumption has likewise been declining as consumers face widespread shortages and rising prices for whatever goods and services consumers are able to purchase. The remaining two indicators—employment and sales—remained positive but are barely hovering above and index level of 0, meaning that growth is barely above historical trends for these categories. Nevertheless, economic growth seemingly remained above trend in the fourth quarter, at least according to the index’s three-month moving average. However, expectations for growth in 2022 are being slashed as a result of the two main problems highlighted above—inflation and supply-chain disruptions—which will likely continue to take a toll on economic conditions for the near future.

January 24, 2022