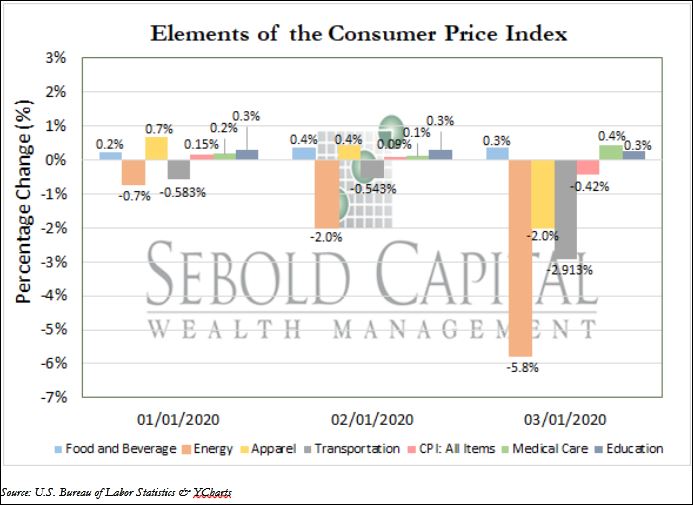

The Consumer Price Index (CPI) tells us of any inflationary pressures in the economy. The CPI measures the average price levels of a basket of goods and services purchased by consumers. The index starts with a base time period (1982-1984, currently) and shows the overall increase since that time. As with many economic indicators, it can be volatile from month to month, with food and energy prices often leading the volatility.

The Consumer Price Index (CPI) tells us of any inflationary pressures in the economy. The CPI measures the average price levels of a basket of goods and services purchased by consumers. The index starts with a base time period (1982-1984, currently) and shows the overall increase since that time. As with many economic indicators, it can be volatile from month to month, with food and energy prices often leading the volatility.

Following three consecutive months of decreases, The Consumer Price Index rose by 0.6% in June. Every component of CPI experienced an improvement this past month with the energy index leading the way and increasing by 5.1%. Core CPI, which excludes food and energy, also rose by 0.2% this month and is positive for the first time since late February. The indices for apparel and motor vehicle insurance had the largest impact on Core CPI this month. Overall, CPI levels are 0.7% higher than this time last year and are expected to continue to rise with the expanding economy.

The CPI increase in June marks the first monthly increase since the beginning of the Coronavirus pandemic in the US. This is an extremely positive indicator that economic activity in the US has reached sustainable and efficient levels compared to those in the last few months. With an economy that is slowly recovering, it is evident that the overall demand for goods and services has risen because consumers are slowly becoming more willing and comfortable to spend. One area or sector that accounted for over half of the monthly increase in the seasonally adjusted CPI index was the energy index. More specifically, the gasoline index in the US rose by 12.3% over the past month. For the sixth consecutive week the US has seen gas prices rise with the national average now sitting around $2.10. This is the highest level that gas prices have reached since the government lifted the stay at home order in late May, and it stems from heightened demand nationwide as Americans return to the road.

Other areas that also contributed to the overall rise in CPI this month were transportation and apparel. These indexes increased by 2.1% and 1.7% thanks to a spike in consumer spending and a universal increase in demand. While growing CPI values reflect a general increase in the price of goods and services, it is a positive sign for the overall economy because it means that consumer spending is continuing to rise even with increasing prices. Consumer spending accounts for nearly 68% of GDP, therefore the increase in CPI this month reflects economic activity that is helping to stabilize and boost overall economic levels. Over the next few months it is predicted that CPI levels will slowly increase assuming that the Coronavirus pandemic does not inhibit further recovery.

July 14, 2020