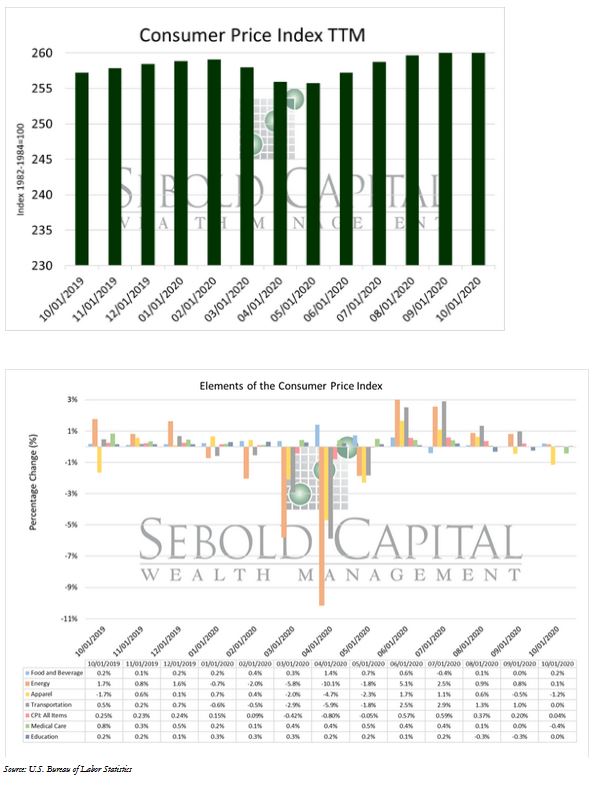

The Consumer Price Index (CPI) tells us of any inflationary pressures in the economy. The CPI measures the average price levels of a basket of goods and services purchased by consumers. The index starts with a base time period (1982-1984, currently) and shows the overall increase since that time. As with many economic indicators, it can be volatile from month to month, with food and energy prices often leading the volatility.

The Consumer Price Index (CPI) tells us of any inflationary pressures in the economy. The CPI measures the average price levels of a basket of goods and services purchased by consumers. The index starts with a base time period (1982-1984, currently) and shows the overall increase since that time. As with many economic indicators, it can be volatile from month to month, with food and energy prices often leading the volatility.

Last month’s CPI remained largely unchanged from the previous month’s figure, only rising 0.04% to a value of 260.3. Food and beverage and energy saw increases of 0.2% and 0.1%, respectively. Transportation and education remained virtually unchanged. Apparel fell by -1.2% and medical care by -0.4%. Core CPI, which excludes food and energy and is therefore less volatile, increased by only 0.01%.

Last month’s Consumer Price Index increase was the smallest in the last five months, a sign that inflation remains low and that consumer demand is starting to cool off and normalize. Economic activity in the services sector remains at relatively low levels, keeping the risk of a significant risk of accelerated inflation low for the time being. As the impact of the Pandemic wanes, however, the increase in the money supply will likely start to exert upward pressure on prices going forward.

November 12, 2020