The Consumer Price Index (CPI) shows us pricing pressures in the economy. The CPI measures the average price levels of a basket of goods and services purchased by consumers. The index starts with a base time period (1982-1984, currently) and shows the overall increase since that time. As with many economic indicators, it can be volatile from month to month, with food and energy prices often leading the volatility.

The Consumer Price Index (CPI) shows us pricing pressures in the economy. The CPI measures the average price levels of a basket of goods and services purchased by consumers. The index starts with a base time period (1982-1984, currently) and shows the overall increase since that time. As with many economic indicators, it can be volatile from month to month, with food and energy prices often leading the volatility.

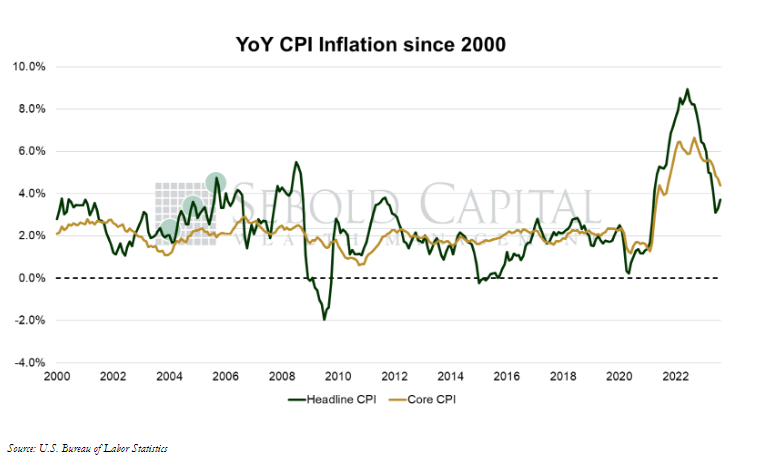

In August, the CPI increased to 306.27 from 304.35. On a monthly basis, consumer prices increased by 0.6%, right in line with expectations. This was the largest monthly increase since June 2022. The annual inflation rate saw an increase from 3.2% to 3.7%, slightly above expectations of 3.5%. However, core inflation-which excludes food and energy and is therefore considered to be less volatile-declined for the fifth consecutive month. It fell from 4.7% to 4.3% on an annual basis, while core prices increased by 0.3% from the prior month. Annual core inflation was expected to come in at 4.4%

Headline inflation reaccelerated last month, driven primarily by rising energy prices. Gasoline prices surged 10.6% in a single month, although they are still down 3.3% from last year’s highs. At a broader level, energy prices increased by 5.6% in August. Transportation costs rose 2.6% for the month, and they are up 1.6% relative to the prior year. This was to be expected. However, softer increases in other categories led to core inflation moderating. Housing costs, which make up the largest portion of the index (and an even bigger share of the core index), increased by 0.4% on a monthly basis. They are up 7.3% from the prior year. Housing costs have been one of the primary factors that have kept core inflation elevated, as up to this point, headline inflation had been quickly falling because of energy prices. Now the reverse will likely be true; energy prices will probably cause an increase in headline inflation while core inflation moderates. How long this trend will last is likely dependent on the direction of commodity prices over the next few months.

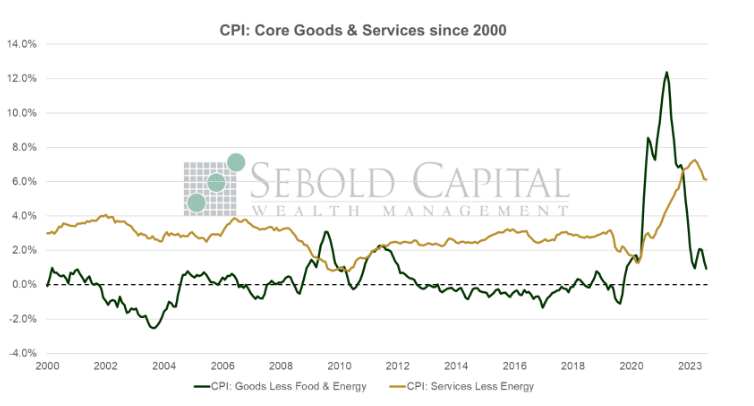

The next question is how this recent increase in headline inflation will impact monetary policy. The hope would be that an increase in gasoline prices would not be sufficient to alter the course of Fed policy and lead to yet another hike in September. Aside from energy prices, most other components of the index are moderating. The price for goods declined by 0.10% from the prior month, while the cost of services increased by 0.4%. On an annual basis goods inflation stands at 0.4%, while services inflation declined from 6.1% to 5.9%. The latter was running as hot as 7.3% earlier this year. The trend continues to appear favorable, although it will be important to keep an eye on energy and shelter costs, as these continue to drive the indices moving forward.

September 13, 2023