The Consumer Price Index (CPI) shows us pricing pressures in the economy. The CPI measures the average price levels of a basket of goods and services purchased by consumers. The index starts with a base time period (1982-1984, currently) and shows the overall increase since that time. As with many economic indicators, it can be volatile from month to month, with food and energy prices often leading the volatility.

The Consumer Price Index (CPI) shows us pricing pressures in the economy. The CPI measures the average price levels of a basket of goods and services purchased by consumers. The index starts with a base time period (1982-1984, currently) and shows the overall increase since that time. As with many economic indicators, it can be volatile from month to month, with food and energy prices often leading the volatility.

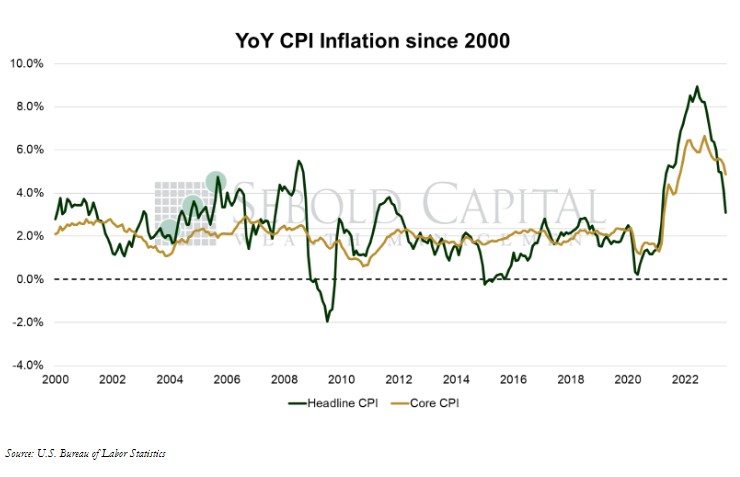

In June, the CPI increased to 303.8, coming in slightly below the expected 303.9 print. On a monthly basis, consumer prices rose by 0.2%. The annual inflation rate declined from 4.0% to 3.0%, its lowest level since March 2021. This was below the expected 3.2% reading. Core inflation, which excludes food and energy and is therefore considered to be less volatile, fell from 5.3% to 4.8%, also coming in below expectations. Core prices increased 0.2% from the prior month as well.

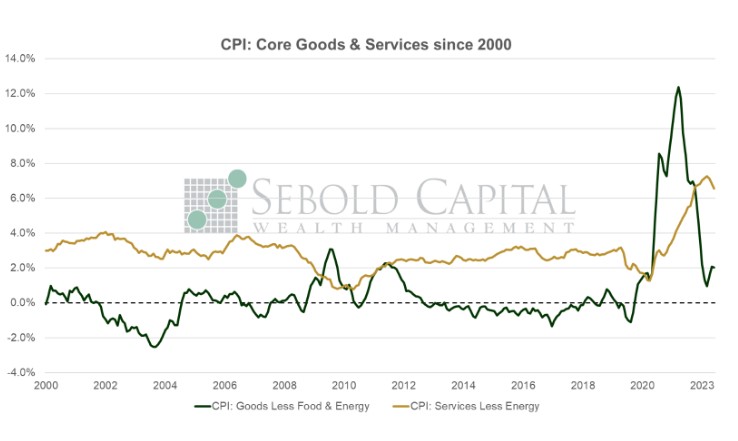

The annual inflation rate continued its rapid decline last month, with much softer increases in prices across the board relative to a year ago. Shelter, the single largest component of the CPI, finally showed signs of moderating. Owners’ Equivalent Rent, which is meant to represent housing costs, increased by 0.4% last month (compared to 0.5% for the last three months); the annual rate declined from 8.1% to 7.8%. Shelter costs have been one of the primary reasons why core inflation has remained so stubbornly high, so seeing those start to moderate is a good sign. Prices for used cars and airline fares both declined last month, which the cost of food and beverages remained nearly unchanged. Prices for goods fell by 0.05% on the month and the annual inflation rate fell from 2.0% to 1.4%. Meanwhile, inflation for services declined from 6.6% to 6.2%, with prices increasing 0.3% on a monthly basis.

Moderating inflation brought with it the first positive real wages print in over two years. On an annual basis, wages increased 0.6% after adjusting for inflation. This inflation report will likely do little to change the trajectory of monetary policy prior to the next FOMC meeting. Fed officials seem determined to deliver at least one, if not two, additional interest rate hikes before the end of the year.

Given the fact that last year’s comparable were very high, coming in at .9% and 1.2% respectively, we do expect a reacceleration of CPI through the rest of this year from a technical perspective. The decline in M2 at a 3.97% rate does suggest that pricing should tighten up towards the end of the year. Based on current comments from Fed officials, however, two more interest rates look likely this year.

July 12, 2023