Durable goods orders, which are orders to buy products that are expected to last at least three years, indicate how busy factories will be in the near future. As the name suggests, durable orders provide a look into demand for equipment along with other big-ticket purchases, such as vehicles and appliances. An increase in capital spending and consumer purchases indicates an increase in business investment and personal consumption in GDP.

Durable goods orders, which are orders to buy products that are expected to last at least three years, indicate how busy factories will be in the near future. As the name suggests, durable orders provide a look into demand for equipment along with other big-ticket purchases, such as vehicles and appliances. An increase in capital spending and consumer purchases indicates an increase in business investment and personal consumption in GDP.

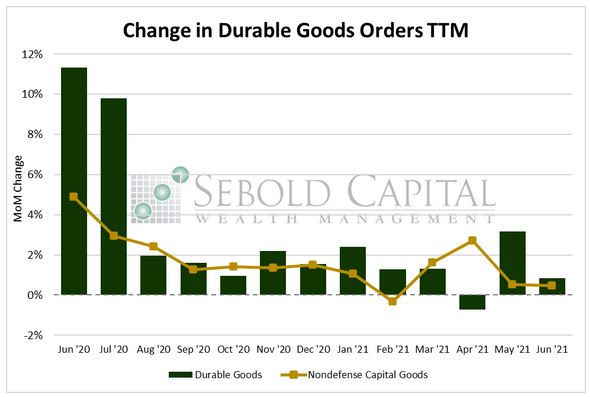

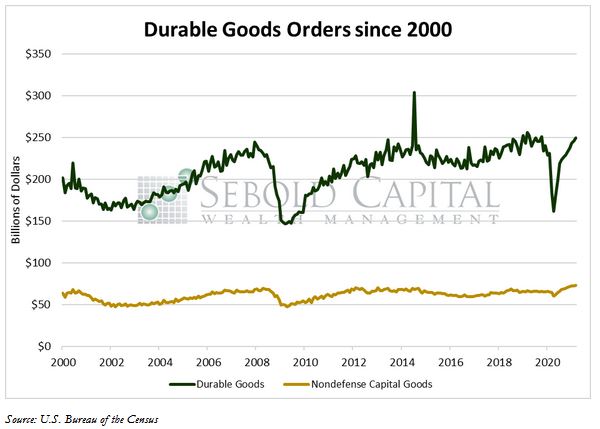

In June, orders for durable goods rose by 0.8% to $257.6 billion, according to the advance estimate provided by the U.S. Bureau of the Census. Orders for nondefense capital goods—which are considered to be an indicator of future business spending plans—increased by 3.1% to $88.9 billion. Capital goods orders have grown by 29.3% over the past twelve months, while orders for nondefense capital goods have soared by 71.9%.

Orders for long-lasting manufactured goods saw a slight increase last month, although they came in well below market expectations. The forecast for the figure was 1.9% and the consensus hovered around 2.1%. Orders were largely bolstered by a sizeable jump in demand for commercial aircraft. Core capital goods, which exclude orders for aircraft and serves as a barometer for business investment, rose by 0.5%. The figure appears to indicate that the pace of economic growth is starting to moderate from last year’s rebound and will likely return to levels that are more consistent with historical trends. Rising costs and raw material shortages are among the factors that have reduced the pace of production. As a result, unfilled orders for manufactured goods rose for the fifth consecutive month, although this should clear up once the supply chain constraints begin ease.

July 27, 2021