Durable goods orders, which are orders to buy products that are expected to last at least three years, indicate how busy factories will be. As the name suggests, durable orders provide a look into demand for equipment along with other big-ticket purchases, such as vehicles and appliances. An increase in capital spending and consumer purchases indicates an increase in business investment and personal consumption in GDP.

Durable goods orders, which are orders to buy products that are expected to last at least three years, indicate how busy factories will be. As the name suggests, durable orders provide a look into demand for equipment along with other big-ticket purchases, such as vehicles and appliances. An increase in capital spending and consumer purchases indicates an increase in business investment and personal consumption in GDP.

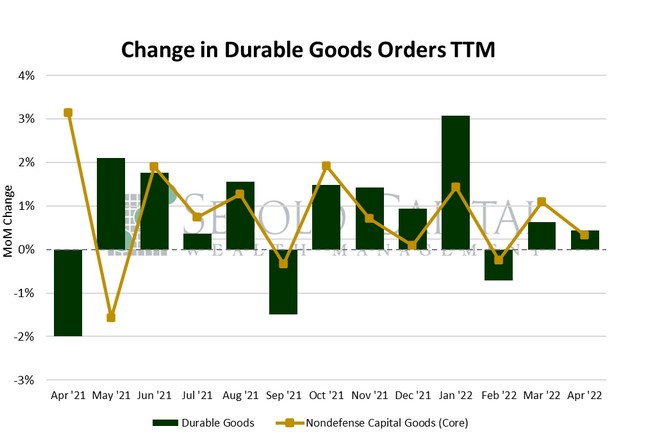

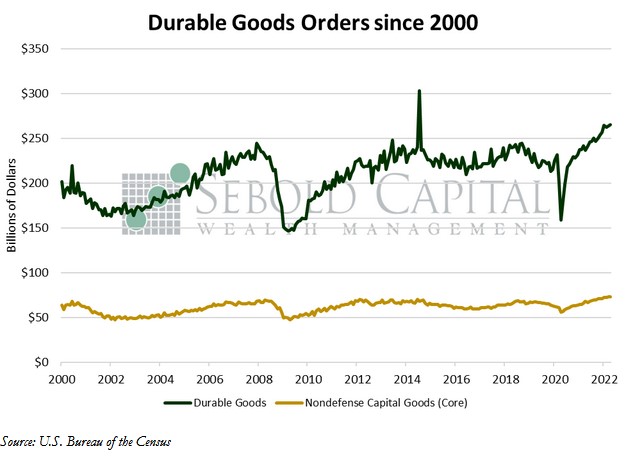

In April, orders for durable goods rose by 0.4% to $265.3 billion, according to the advance estimate provided by the U.S. Bureau of the Census. Orders for nondefense capital goods likewise advanced 0.4% to $83.4 billion, coming in well below market expectations of a 1.0% increase. Excluding aircraft, nondefense capital goods orders rose by a more modest 0.3%, also below market expectations, totaling $73.1 billion.

Orders for long-lasting goods increased last month, however, the reading was the second weakest in the past seven months, indicating that the pace of economic growth continues to moderate. This is hardly surprising, as a combination of rising prices—and now also higher interest rates—are bound to take a toll on demand. Ongoing supply chain disruptions are not helping either; recent lockdowns in China have delayed the shipment of goods and raw materials and added to the already existing pressures. Demand for capital goods remains high from a historical perspective; on a year-over-year basis, orders for durable goods rose by 12.2%. However, stripping out certain categories like defense spending (which is naturally not driven by consumer demand) and commercial aircraft paints a picture of softening demand. Core capital goods, which exclude both of the aforementioned categories, rose by 7.5% on an annual basis. Not bad, but when compared to a 10.5% increase in March and 11.6% in February, it looks a lot less impressive. The outlook for capital goods, and by extension the economy as a whole, remains uncertain. By now, it is quite clear that the economy contracted in the first quarter. The second GDP estimate, which was just released, showed a 1.5% decline. Growth is definitely slowing; the key will be to identify the cause. Is it supply chain, increased commodity prices, or the constant drum banging of “the economy must slow down” from analysts and the media?

February 26, 2022