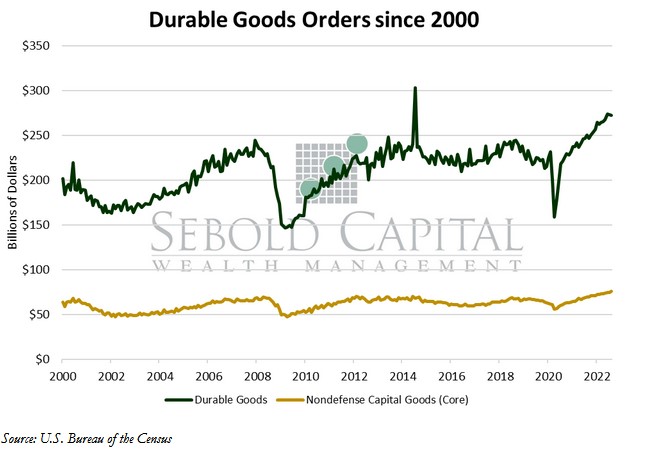

Durable goods orders, which are orders to buy products that are expected to last at least three years, indicate how busy factories will be. As the name suggests, durable orders provide a look into demand for equipment along with other big-ticket purchases, such as vehicles and appliances. An increase in capital spending and consumer purchases indicates an increase in business investment and personal consumption in GDP.

Durable goods orders, which are orders to buy products that are expected to last at least three years, indicate how busy factories will be. As the name suggests, durable orders provide a look into demand for equipment along with other big-ticket purchases, such as vehicles and appliances. An increase in capital spending and consumer purchases indicates an increase in business investment and personal consumption in GDP.

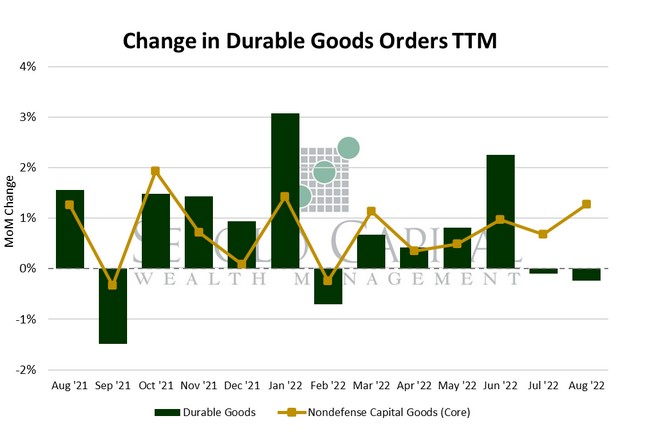

In August, orders for durable goods declined by 0.2% t0 $272.7 billion, beating market expectations of a 0.4% decline. However, orders for nondefense capital goods fell by 0.9%, compared to the expected 0.3% advance. Core capital goods, which also exclude aircraft orders, rose by 1.3%, totaling $75.6 billion for the month and beating expectations of a 0.2% advance.

Orders for long-lasting goods declined slightly last month—at least the headline did. Most the decline was driven by fewer aircraft orders, which sank 18.5%; excluding that volatile category, durable goods orders rose at the fastest pace since January. That measure is particularly insightful because it serves as an indicator of business spending—and by extension their outlook on the economy. Even as recession fears have intensified and the cost of capital has increased, business spending has remained particularly robust throughout the summer. This may be easy to miss, as fluctuations in the transportation segment often exaggerate the swings in capital investment by firms. Besides aircrafts, the only category that did not post an increase last month was metal products, which fell by 0.7%. Defense spending saw a significant increase last month, although it is quite difficult to gauge anything about economic conditions based on what the government spends. Robust business spending, despite headline weakness, suggests that economic conditions may not be as dire as some suggest—and therefore increases the odds that the Fed will remain hawkish for longer. That said, business spending (which maps to the investment category of GDP) has less of an impact on the economy than consumer spending, so those numbers should be given greater weight when judging the underlying strength of the US economy.

.

September 27, 2022