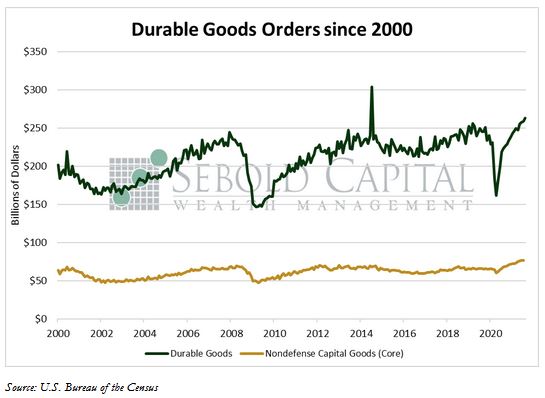

Durable goods orders, which are orders to buy products that are expected to last at least three years, indicate how busy factories will be. As the name suggests, durable orders provide a look into demand for equipment along with other big-ticket purchases, such as vehicles and appliances. An increase in capital spending and consumer purchases indicates an increase in business investment and personal consumption in GDP.

Durable goods orders, which are orders to buy products that are expected to last at least three years, indicate how busy factories will be. As the name suggests, durable orders provide a look into demand for equipment along with other big-ticket purchases, such as vehicles and appliances. An increase in capital spending and consumer purchases indicates an increase in business investment and personal consumption in GDP.

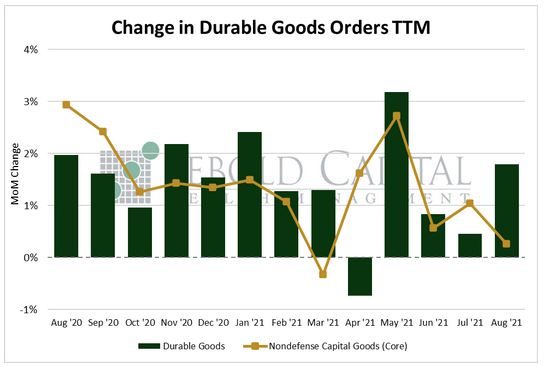

In August, orders for durable goods rose by 1.8% to $263.5 billion, according to the advance estimate provided by the U.S. Bureau of the Census. Orders for nondefense capital goods surged by 9.0% to $89.9 billion, mainly due to a large increase in aircraft orders. Excluding the latter, nondefense capital goods orders only rose by 0.5% for the month, totaling $77.1 billion.

Orders for long-lasting goods increased last month despite the material and labor shortages that manufacturers continue to face. Orders for new commercial airplanes made up the majority of August’s advance, soaring by 78%. Airplane orders tend to be rather volatile from month to month and are not an ideal gauge to judge the conditions for the manufacturing industry. However, a large boost in aircraft orders usually corresponds with expectations of a sustained increase in travel and transportation activities, and therefore favorable economic conditions. That said, manufacturers are still facing challenges, mainly higher input costs, supply-chain disruptions, and difficulties finding workers. As a result, shipments of durable goods declined by 0.5% and unfilled orders rose by 1.0% in August. These disruptions, coupled with rising prices, could dampen the relatively robust demand for capital goods that manufacturers have seen for the past several months. So-called core capital goods—which exclude aircraft orders—have increased for fifteen out of the last sixteen months, but given the aforementioned conditions, this may not be sustainable.

September 27, 2021