The Employment Situation is a report by the Bureau of Labor Statistics that gives us a look at the employment outlook of the US economy. The report does not include those employed in agriculture because of the seasonal nature of their work. This report obtains these numbers from 142,000 businesses and government agencies to track the new jobs added in non-farming sectors of the economy.

The Employment Situation is a report by the Bureau of Labor Statistics that gives us a look at the employment outlook of the US economy. The report does not include those employed in agriculture because of the seasonal nature of their work. This report obtains these numbers from 142,000 businesses and government agencies to track the new jobs added in non-farming sectors of the economy.

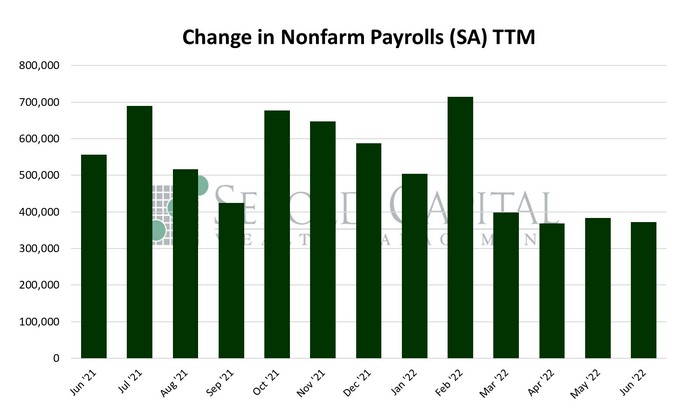

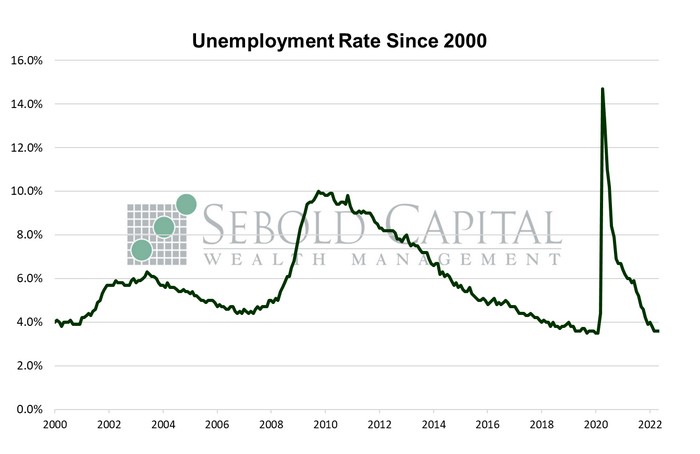

In June, U.S. employment rose by 372,000 on a seasonally adjusted basis, coming in above market expectations of a 300,000 advance. The headline unemployment rate remained unchanged for the fourth consecutive month at 3.6%. The average workweek likewise remained unchanged at 34.5 hours. Average hourly earnings rose modestly from $31.98 to $32.08, while average weekly earnings rose from $1,103.31 to $1,106.75. The labor force participation rate declined slightly from 62.3% to 62.2%. About 353,000 people left the labor force in June, completely erasing May’s gain of 330,000, and then some. The labor force participation rate remains below its pre-pandemic level of 63.4%.

Despite expectations of a significant slowdown, employment continued to increase at a relatively robust pace last month. Job gains did slow in relation to the previous month, but they remain at a level that can be considered “normal,” especially when compared to pre-pandemic levels. In fact, June’s report screams, for the most part, “normal.” The unemployment rate appears to have flatlined, but at a level that is consistent with full employment. However, the unchanging unemployment rate does obscure some labor market dynamics that are worrisome; people keep leaving the workforce, even at a time when jobs are plentiful. One danger is that, if these people remain out of the workforce for long enough, their skills might erode and to the point where finding suitable employment becomes nearly impossible—even if the labor market remains robust. If that happens, then this seemingly temporary reduction in employment might become more permanent, casting doubt in the prospects for future economic growth.

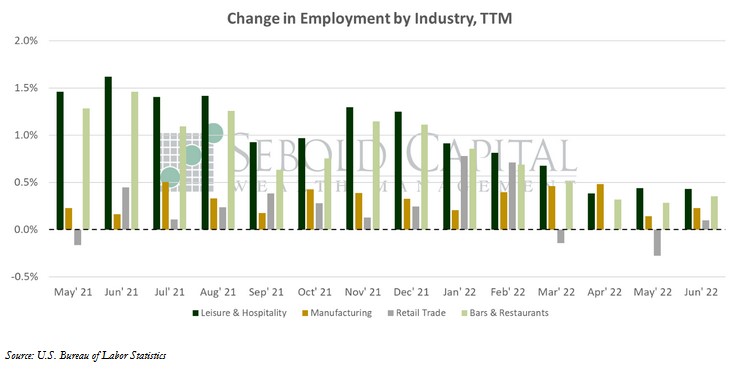

Employment growth was widespread, led by gains in the education and health services, leisure and hospitality (most of which was driven by bars and restaurants), and professional services sectors. Employment in the manufacturing industry has also returned to pre-pandemic levels. Government was the only major category to shed payroll in the last month, losing about 9,000 employees plus a few more from revisions. Overall, labor demand remains robust, even if the supply is not necessarily there to fully meet it. Looking exclusively at the labor market, there are no signs of a looming recession. If anything, economic conditions are normalizing, and given the state of the labor market immediately following the pandemic, that requires somewhat of a slowdown. Even in the most ideal of economic conditions, adding over half-a-million jobs every month is not sustainable in the long run.

July 8, 2022