The Employment Situation is a report by the Bureau of Labor Statistics that gives us a look at the employment outlook of the US economy. The report does not include those employed in agriculture because of the seasonal nature of their work. This report obtains these numbers from 142,000 businesses and government agencies to track the new jobs added in non-farming sectors of the economy.

The Employment Situation is a report by the Bureau of Labor Statistics that gives us a look at the employment outlook of the US economy. The report does not include those employed in agriculture because of the seasonal nature of their work. This report obtains these numbers from 142,000 businesses and government agencies to track the new jobs added in non-farming sectors of the economy.

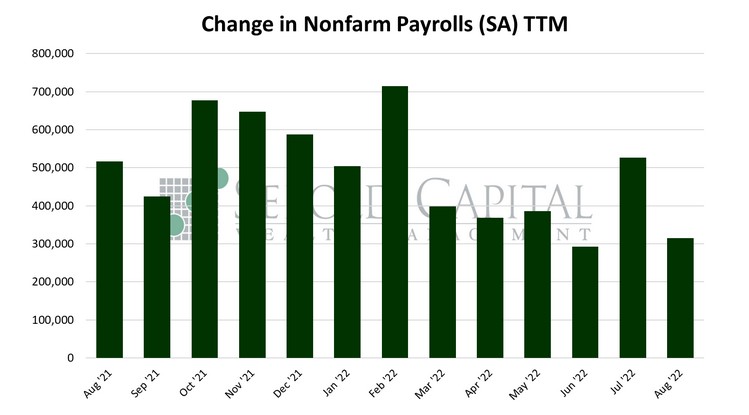

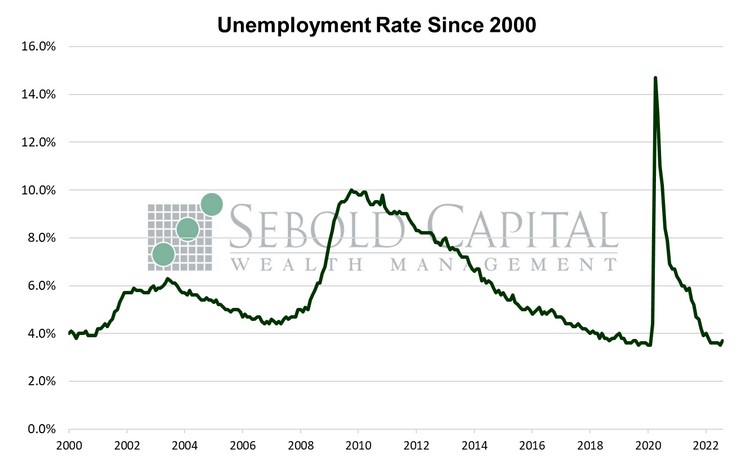

In August, U.S. employment rose by 315,000 on a seasonally adjusted basis, coming in slightly above market expectations of a 310,000 advance. However, the prints for the previous two months were revised to the downside by a cumulative 107,000, yielding a smaller net gain in payrolls. The headline unemployment rate rose from 3.5% to 3.7%—its highest value since February. The average workweek remained nearly unchanged, declining from 34.6 to 34.5 hours. Average hourly earnings increased $0.10 to $32.26, while average weekly earnings remained unchanged at $1,116. The labor force participation rate increased last month, rising from 62.1% to 62.4% and reaching its highest reading since March. Nevertheless, labor force participation remains below its pre-pandemic level of 63.4%.

Last month, hiring slowed down relative to July’s unexpectedly high increase, but continued at a solid pace by historical standards. While August’s print was the second smallest one so far this year, the overall report reveals that the labor market remains robust. Sure, the unemployment rate increased last month. At first glance, one might be puzzled as to why a higher jobless rate would be good news. Well, that is because the labor force saw its largest increase in seven months, meaning more people came back to the labor market at a time when there is a shortage of workers. The 786,000 increase was enough to offset the net 449,000 reduction in the size of the labor force over the past four months, and then some. In fact, that brought the size of the labor force above pre-pandemic levels, although the participation rate remains lower because the population level has increased substantially since then.

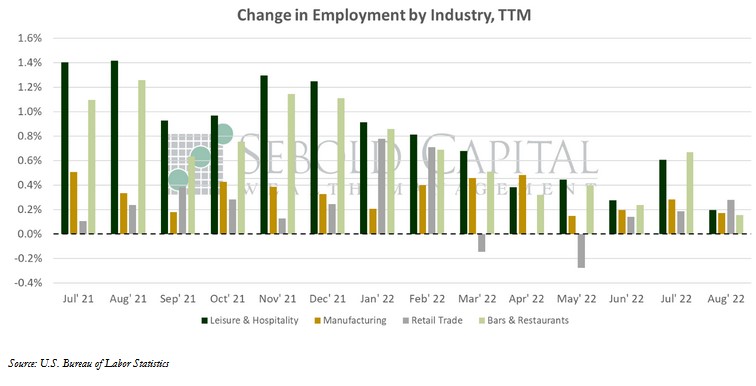

Much of the hiring in August was driven by the professional services, transportation and warehousing, and retail sectors. In contrast to previous months, the leisure and hospitality sector saw considerably more moderate hiring, but payrolls increased nonetheless. Other sectors, such as information and government, likewise saw slower hiring. Overall, this report suggests that the chances of a soft landing are perhaps a bit higher than previously thought. Employment shows continued momentum despite an accelerated Fed tightening cycle, while simultaneously allowing for some slack in the labor market to develop which would help reduce price pressures on the overall economy. That, combined with more moderate energy prices, increases the odds that we might be able to return to milder inflation in the near term without the Fed needing to inflict “significant pain” on the economy by continuing to increase rates at a rapid pace. The Fed has shown that they are willing to respond to shifting economic data, so they will likely take this report into consideration at their meeting this month. However, how they will react to it remains to be seen.

September 2, 2022