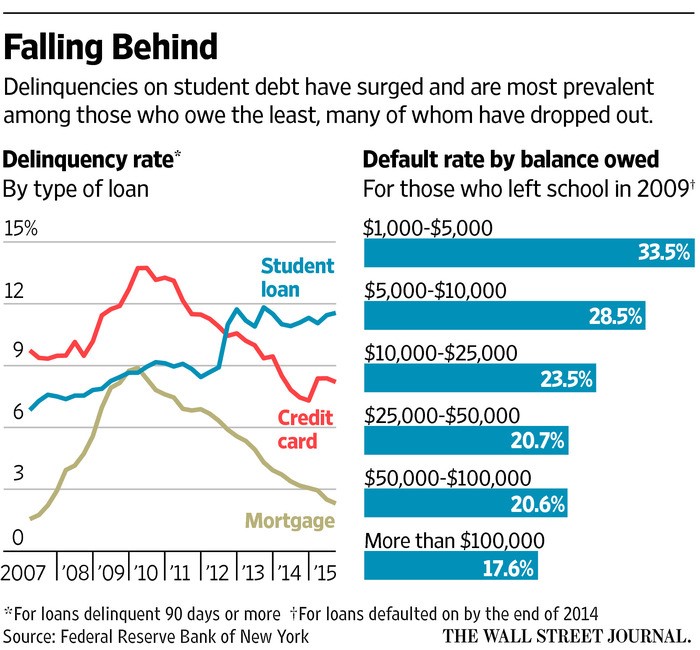

It should come as no surprise that delinquencies on student loans have been on the rise given the dramatic increase in student loan debt outstanding. As we can see from the graph below, the delinquency rate on student loan debt is now more than the rate on credit cards and mortgages and has been increasing since before the recession. A large portion of these delinquencies have come from borrowers with the lowest amount of debt outstanding.

Research done at Stanford University and the Treasury Department have found that the higher delinquency rates come mainly from students that dropped out of school and what they call “nontraditional students,” students enrolling at community colleges and colleges that have lower academic enrollment standards. When students drop out they tend to ignore the debt that they promised to repay when accepting the loan.

Currently, almost anyone can take on student debt to attend school. Some propose that underwriting standards be met, such as an examination of high school grades, test scores, and the job placement history of the school the student wishes to attend. Imposing some form of underwriting might slow the growth of delinquencies, but will most likely prevent some students from obtaining loans they need to attend college.

December 10, 2015