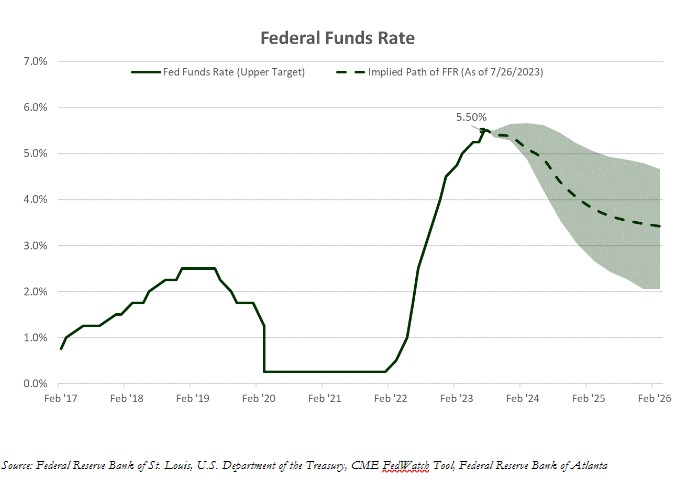

After a short pause that lasted only one meeting, the FOMC opted to deliver yet another quarter-point hike on Wednesday. This decision marked the eleventh hike in this cycle and brought the Fed Funds Rate to a 22-year high, with an upper target of 5.50% and a lower target of 5.25%. The target rate has now surpassed the highs of the 2006-2008 tightening cycle, when rates peaked at 5.25%. Fed Chairman Jerome Powell gave little guidance on what to expect next, only stating that the Fed would continue to be data dependent. Depending on the Fed’s interpretation of upcoming data, this may or may not be the end of this cycle of rate hikes.

After a short pause that lasted only one meeting, the FOMC opted to deliver yet another quarter-point hike on Wednesday. This decision marked the eleventh hike in this cycle and brought the Fed Funds Rate to a 22-year high, with an upper target of 5.50% and a lower target of 5.25%. The target rate has now surpassed the highs of the 2006-2008 tightening cycle, when rates peaked at 5.25%. Fed Chairman Jerome Powell gave little guidance on what to expect next, only stating that the Fed would continue to be data dependent. Depending on the Fed’s interpretation of upcoming data, this may or may not be the end of this cycle of rate hikes.

There is evidence to support an extended pause-one that is longer than two months of no rate changes. The data tells us that overall inflation is moderating, although core inflation’s apparent refusal to relent was one of the primary justifications used by the Fed to support another hike. Core inflation has remained elevated in great part due to its housing component, which is given a greater weight due to the absence of food and energy prices. The BLS uses “owners’ equivalent rent” or OER as a proxy for housing costs. The true cost of housing fluctuates with supply and demand of properties, in addition to interest rates and other factors. OER has shown to be a lagging indicator on real pricing of property.

In addition to stubborn core inflation, overall economic conditions appear to remain too favorable for the Fed’s liking. Obsessing over every word of FOMC statements is now tradition for the markets, but the most important takeaway of July’s statement was replacing “modest” with “moderate” when describing the pace at which the economy is expanding. While some private-sector indicators like the PMIs might cast doubt upon that assertion, other indicators like Retail Sales are indeed increasing at a pace that can be described as moderate. Employment data has lately proven too noisy to draw any definitive conclusions, but two things seem clear-the unemployment rate remains steadily near record lows, and the economy is no longer adding half-a-million jobs every month like it was before. On average, employment growth appears to be back to pre-pandemic levels.

Arguably, the most compelling reason for an extended pause is that monetary policy is known to operate with a long and variable lag. The full impact of all of the Fed’s policy actions has likely not been fully felt yet. Rate hikes typically get all the attention, but the Fed is still shrinking its balance sheet. The money supply (M2) has shrunk 3.75% relative to the previous year. Should this continue, we will see slowing effects on the overall economy. Goldilocks will need to peddle harder in the future.

July 28, 2023