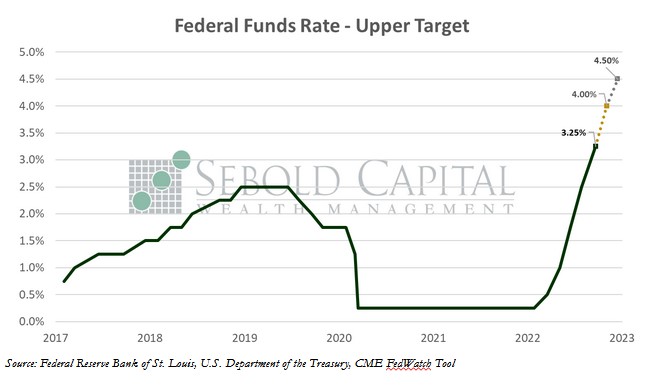

In its latest meeting, the FOMC delivered yet another 75-basis-point interest rate hike—the third one this year—as it continues to fight inflation. That lifted the target federal funds rate to a range between 3% and 3.25%. This level of interest rates has not been seen since early 2008, although it remains below the highs reached during other tightening cycles. The current expectation is for the Fed to raise its upper target to 4.5% by the end of the year, meaning that a pivot in Fed policy is highly unlikely.

In its latest meeting, the FOMC delivered yet another 75-basis-point interest rate hike—the third one this year—as it continues to fight inflation. That lifted the target federal funds rate to a range between 3% and 3.25%. This level of interest rates has not been seen since early 2008, although it remains below the highs reached during other tightening cycles. The current expectation is for the Fed to raise its upper target to 4.5% by the end of the year, meaning that a pivot in Fed policy is highly unlikely.

The market had arguably already priced in the third 0.75% hike, however, the market seemed concerned about the forward guidance. The Fed indicated that it is prepared to keep hiking rates well above their current level. Fed officials also indicated that they expect this rapid increase in interest rates to have consequences; the Summary of Economic Projections, which was released alongside the interest rate decision, pointed to expectations of higher unemployment and slower economic growth. Forecasted GDP growth for 2022, which stood at 1.7% in June, was sharply cut to 0.2%. Their hope is that this more aggressive tightening will reduce inflation (as measured by the core PCE price index, the Fed’s preferred measure) from its latest level of 4.6% to its 2% target by 2025. Fed officials see the key measure remaining nearly unchanged from its current print by the end of the year, at a level of 4.5%.

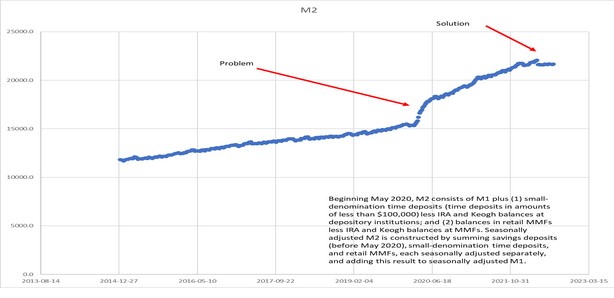

We find it interesting that all the discussion about inflation is only targeted around the Fed Funds rate and quantitative tightening. The real elephant in the room is Fiscal Policy. The amount of excess money that has been printed over the last decade remains in the system. M2, the measurement of this money supply has jumped nearly 40% in the past year. If the Fed continues to raise rates, yet the money supply does not come down, the result is higher interest rates, lower growth and continued price hikes.

If the Fed continues to make this mistake of using the blunt instrument of short-term interest rates to solve our monetary problems, we could be in for a long slog. If we see M2 flatten or decline, we will be headed in the right direction. We hope our policy makers begin to see the light.