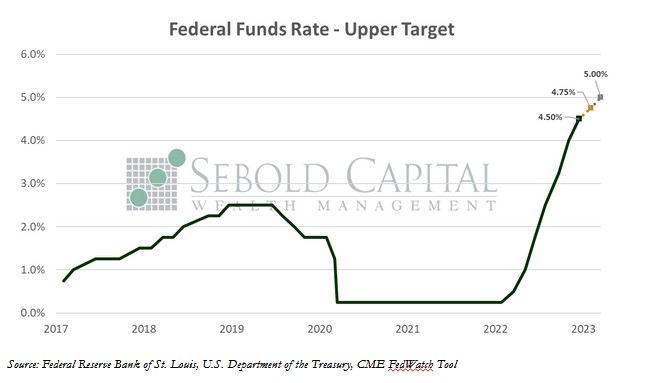

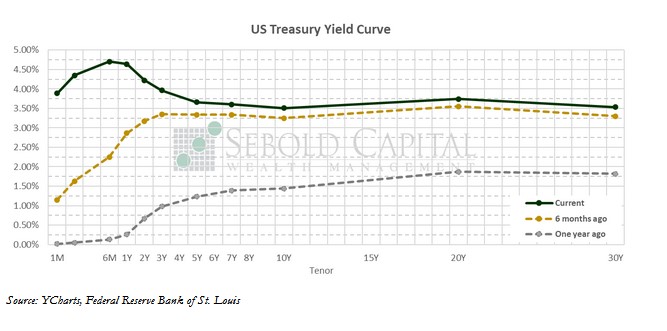

As expected, the FOMC delivered its final interest rate hike for the year at its latest meeting, this time opting for a relatively more moderate 50 basis points compared to the previous four hikes of 0.75% each. This moved the upper target of the Fed Funds Rate to 4.5%, and the lower target to 4.25%. Despite the more conservative increase, Fed officials are now seeing a higher terminal rate, likely above 5%, for next year. Estimates for inflation and unemployment were also higher relative to September expectations.

It also appears that the Fed is ready to further moderate its hikes to the more customary quarter-point. While Chairman Powell did not explicitly endorse it, he seemed quite open to the idea. Such a hike is what the market is currently pricing in for the first meeting of next year in February, with a 58.8% probability. Improving inflation data likewise supports a return to normalcy, from a monetary policy perspective.

A day prior to the announcement, we got the November CPI print. It came in below expectations and showed a meaningful slowdown in inflation relative to the previous month. The headline rate declined from 7.7% to 7.1%, with prices only increasing 0.1% for the month. The core print retreated to 6.0% from 6.3%; core prices rose 0.2% last month. PPI numbers from the previous week also showed price pressures continuing to improve. It is unlikely that FOMC officials considered the latest inflation print at their meeting, but it certainly provides room for them to be somewhat less aggressive with monetary policy tightening in 2023.

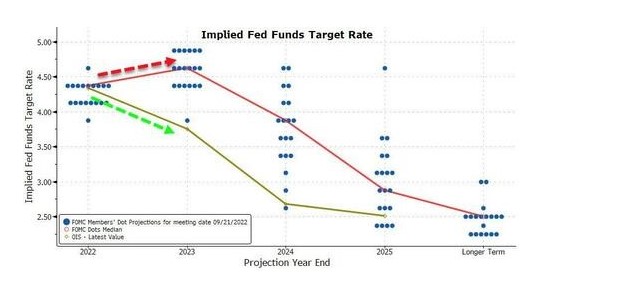

As mentioned above, the Fed’s economic projections have deteriorated from their last release in September. The median forecast has GDP a mere 0.5% higher by the fourth quarter of next year, while the unemployment rate is expected to increase by nearly 1%. Core PCE—the Fed’s preferred measure of inflation—is now expected to end 2023 at 3.5%, up from the 3.1% projection from the September meeting. That is a puzzling assumption, since a slower economy should help bring down inflation more quickly. The impact of interest rates in the economy generally has a relatively long and variable lag. It is likely that the impact of the more aggressive 0.75% hikes between June and November will only start being felt early next year. That, coupled with recent data, points to inflation perhaps moderating at a faster pace than what the Fed now expects. Let’s see how willing they are to be “data-dependent.”

December 14, 2022