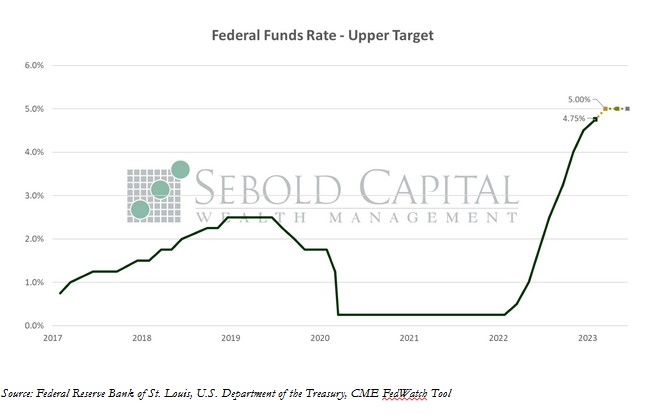

As expected, the FOMC delivered its first interest rate hike for the year at its latest meeting. After several rounds of unusually large rate hikes last year, we are now back to a modest 25 basis points. This latest hike moved the upper target of the Fed Funds Rate to 4.75%, and the lower target to 4.5%. We are 50 basis points away from what Fed officials penciled in as their terminal rate – 5.25% – after their December meeting, with two additional quarter-point rate hikes likely to come in the March and May meetings.

As expected, the FOMC delivered its first interest rate hike for the year at its latest meeting. After several rounds of unusually large rate hikes last year, we are now back to a modest 25 basis points. This latest hike moved the upper target of the Fed Funds Rate to 4.75%, and the lower target to 4.5%. We are 50 basis points away from what Fed officials penciled in as their terminal rate – 5.25% – after their December meeting, with two additional quarter-point rate hikes likely to come in the March and May meetings.

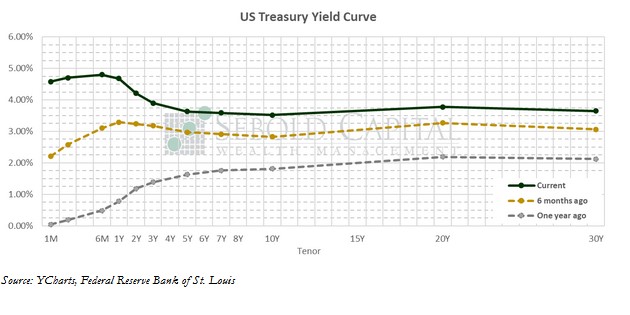

Whether the Fed will be done hiking after that remains unclear, although the markets seem to think they will. By the Fed’s own admission, the inflation outlook has improved, whereas most other economic data has shown weakness in the economy. Consumer spending was weak in December, and housing data was abysmal. The day of the announcement, manufacturing data came in below expectations and below a key level. Employment data, which will be released on Friday, is expected to continue to soften. The labor market has yet to see a drastic slowdown (in the data at least), but it seems that company announced layoffs are happening every other day. Keeping in mind that most monetary policy has a relatively long and variable lag, continuing to hike will just pile on bad economic data without having any additional impact on inflation data.

Fed officials remain concerned about strong wage pressures, a tight labor market, and inflation that remains persistently high in the services sector. These are likely the reasons that drive their decision to pencil in at least two more rate hikes for the year. The markets are currently pricing in rate cuts later this year, although that is unlikely to happen given how hard the Fed has fought to restore some of the credibility it lost after their “transitory inflation” blunder in 2021. Barring some financial catastrophe, it is possible that the Fed would hit there one more target 25 bps hike in March, and then put interest rates in “pause” mode for the balance of the year.