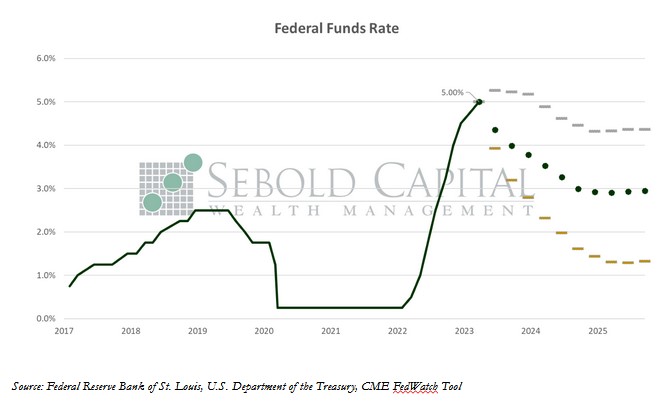

At its most recent policy meeting, the FOMC delivered its second interest rate hike for the year and the ninth this hiking cycle. They opted for another quarter-point hike, just as they did in February. This moved the upper target of the Fed Funds Rate to 5.0%, and the lower target to 4.75%-the highest level since September 2007.

At its most recent policy meeting, the FOMC delivered its second interest rate hike for the year and the ninth this hiking cycle. They opted for another quarter-point hike, just as they did in February. This moved the upper target of the Fed Funds Rate to 5.0%, and the lower target to 4.75%-the highest level since September 2007.

However, a lot has changed since the Fed met in early February. Expectations for what would happen at the March meeting have swung wildly. Hotter than expected employment data led the market to speculate that a return to more aggressive approach was likely, pricing in 0.50% at one point. However, those expectations quickly reversed after the collapse of Silicon Valley Bank, at one point favoring a pause of the hiking cycle. In the end, we got another moderate quarter-point hike, which largely matched expectations of the days leading up to the meeting.

The likelihood of a complete pause of the rate hike cycle was always low, even as concerns for the banking sector continued to mount. However, a return to half-point hikes would have been excessive, even without any banks collapsing. While the last jobs report came in once again above expectations, it is likely that seasonal factors had an impact on the data. The inflation data released prior to the FOMC meeting suggested that inflation had resumed its downward trajectory, implying that an aggressive monetary policy was unnecessary. Retail sales were also weaker than expected.

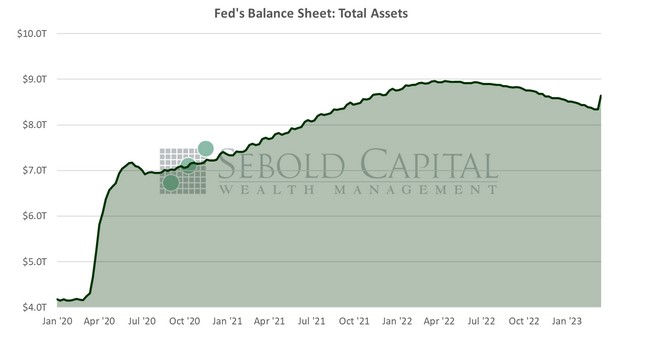

While the handful of casualties in the banking sector were not enough to warrant a complete pause of the hiking cycle, they did essentially put an end to quantitative tightening, at least for now. After months of a consistent downtrend, the Fed’s balance sheet jumped 3.6% in a single week as the central bank rushed to provide liquidity for the banking sector. While Chairman Powell emphasized that this was temporary and did not represent a shift in policy, it still undid about five months of progress in shrinking the gargantuan balance sheet, which stands at about $8.64 trillion.

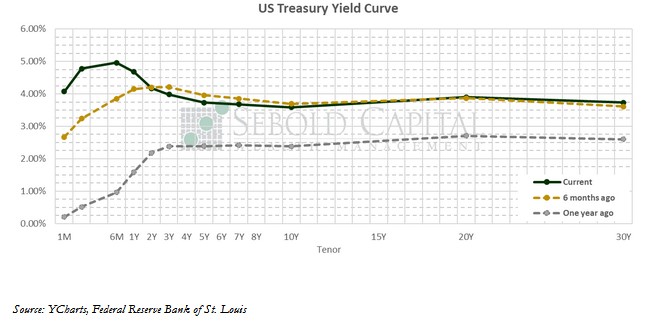

Where the Fed goes from here remains to be seen. The implied terminal rate has been 5.25% for some time now; we are one quarter-point hike away from that level, likely to come at the May meeting. However, a pause of the hiking cycle at this point would not be unreasonable. The market continues to largely expect lower interest by the end of the year, with the current implied rate in December at 3.77%. While that kind policy change seems farfetched, the data currently supports—and will likely continue to support—a far less aggressive monetary policy.

Where the Fed goes from here remains to be seen. The implied terminal rate has been 5.25% for some time now; we are one quarter-point hike away from that level, likely to come at the May meeting. However, a pause of the hiking cycle at this point would not be unreasonable. The market continues to largely expect lower interest by the end of the year, with the current implied rate in December at 3.77%. While that kind policy change seems farfetched, the data currently supports—and will likely continue to support—a far less aggressive monetary policy.

March 22, 2023