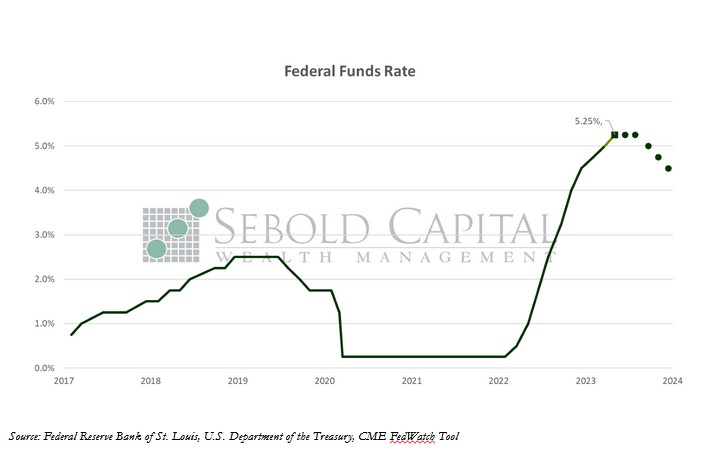

At its most recent policy meeting, the FOMC delivered its third-and possibly its last-interest rate hike for the year. It also marked the tenth hike this tightening cycle. As expected, this was another quarter-point hike, which moved the upper target of the Fed Funds Rate to 5.25% and the lower target to 5.0%-the highest level since June 2007.

At its most recent policy meeting, the FOMC delivered its third-and possibly its last-interest rate hike for the year. It also marked the tenth hike this tightening cycle. As expected, this was another quarter-point hike, which moved the upper target of the Fed Funds Rate to 5.25% and the lower target to 5.0%-the highest level since June 2007.

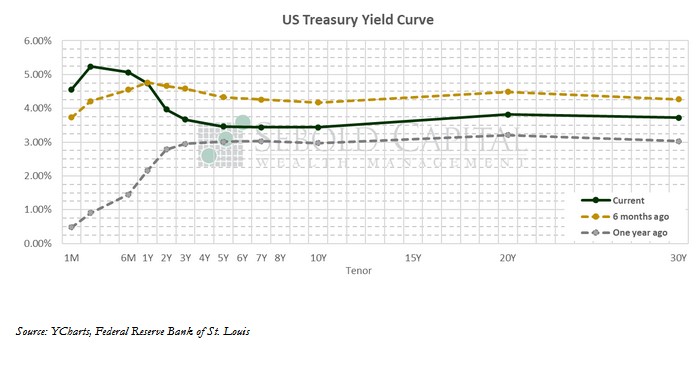

The Fed may have finally concluded what has arguably been its most aggressive tightening cycle and reached the terminal rate, which despite some speculation, had always been expected to be in the range of 5% to 5.25%. Fed officials have acknowledged the gradual moderation in economic activity that we have seen throughout this year-generally softer employment and consumer numbers, gradual disinflation (with monthly numbers telling the most compelling story), and credit conditions that are starting to tighten. Credit conditions played an important role in the official statement, as the FOMC replaced the comment about the possibility of their actions creating tighter credit conditions with the acknowledgement that they had, in fact, created tighter credit conditions.

Another milestone that emerged from this last meeting was the Fed Funds Rate turning positive in real terms for the first time since 2019. This, along with the direction in which M2 is moving, points to inflation continuing to decline over the next several months. Despite this, Fed officials do not appear to even be considering any kind of easing at this time. According to their statement, they can not make a decision regarding a pause until the data supports it. The data does not support any cuts for the time being. The markets continue to price the Fed Fund Futures to anticipate that rates will be lower by the end of the year. Based on FOMC statements alone, that seems unlikely—although the markets have been ahead of the Fed since this saga began.