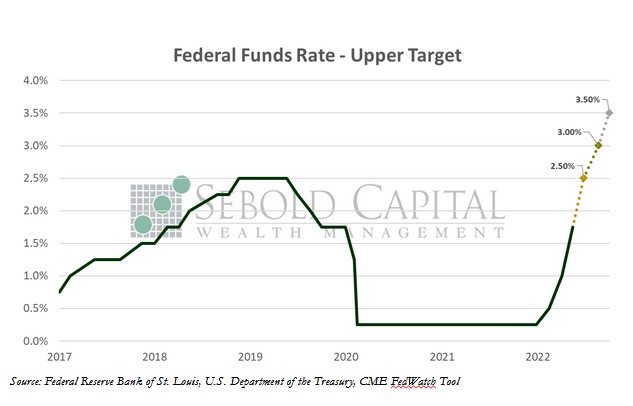

In an abrupt change from what had been precise guidance, the FOMC announced on Wednesday that it was raising interest rates by 75 basis points in an attempt to tame what has clearly become persistently high inflation. This was the largest interest rate increase since 1994. The decision, which would have been a surprise a week ago, largely followed market expectations. However, that did not keep the markets from selling off the day after the announcement. The shift from what the Fed had previously hinted would be another half-point hike likely originated from the latest inflation data, which showed that inflation had not peaked in April and instead accelerated in May.

In an abrupt change from what had been precise guidance, the FOMC announced on Wednesday that it was raising interest rates by 75 basis points in an attempt to tame what has clearly become persistently high inflation. This was the largest interest rate increase since 1994. The decision, which would have been a surprise a week ago, largely followed market expectations. However, that did not keep the markets from selling off the day after the announcement. The shift from what the Fed had previously hinted would be another half-point hike likely originated from the latest inflation data, which showed that inflation had not peaked in April and instead accelerated in May.

Indeed, inflation—at least how the CPI measures it—came in hotter than expected just days before the meeting; while forecasts called for an annual rate of 8.3%, the headline print came in at 8.6%. The Producer Price Index also accelerated on a month-over-month basis. A three-quarter-point rate may be shocking under normal circumstances, but it almost pales in comparison to the current inflationary environment. After all, real interest rates remain firmly in negative territory and a Fed Funds Rate ranging from 1.5% to 1.75% can hardly be considered “high” by historical standards. Nevertheless, the Fed deserves some credit. Increasing rates by more than they had previously, hinted at they are at least trying. It is unfortunate, however, that a 75-basis point hike was essentially taken off the table at the last meeting; this reversal makes the Fed seem inconsistent, which is not a good look for those setting monetary policy.

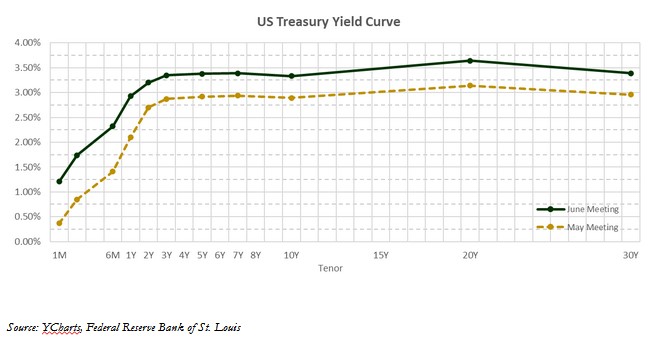

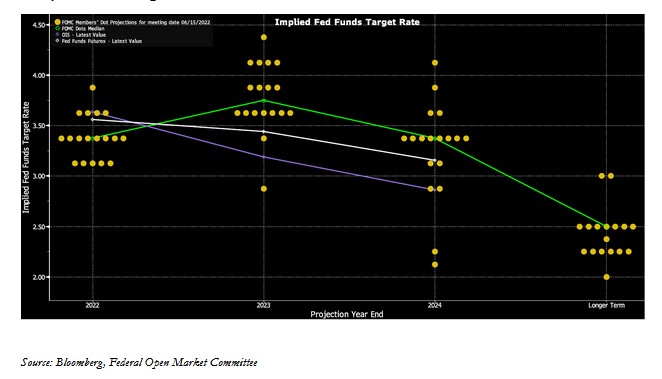

After the meeting, at the press conference, Fed Chairman Jerome Powell hinted that another 75-basis point hike was likely at the next FOMC meeting, to be held in July. Given his track record, perhaps that means that a full 1% hike is coming—it is certainly closer to what we need. The committee’s economic projections now show that all 18 officials expect rates to be at least 3% by the end of this year. The futures market is pricing in a 3.5% upper target. It will be interesting to see what that does to market interest rates, which so far have outpaced official policy by a wide margin. For instance, the two-year Treasury yield rose at the fastest pace since 1982 in the days preceding the meeting. Mortgage rates also saw their biggest one-week increase 1987 and currently sit at 5.78% for a 30-year loan, the highest level since 2008.  A key takeaway from the meeting was also the official shift in the Fed’s policy intentions. Previously, they had only stated that they were looking to move interest rates to what they considered to be a neutral level. Now, Powell openly admitted that the central bank was pursuing a restrictive policy—one designed to slow the economy. Although he clarified that causing a recession was not the Fed’s intent, history shows that the Fed is not great at engineering soft landings. Consumer confidence is already at all-time lows, and spending seems to be slowing down. Unemployment remains low, but inflation continues to give workers a pay cut in real terms and erode their purchasing power. A policy mistake is not an impossibility, and it will likely not take a big one to push the economy over the edge.

A key takeaway from the meeting was also the official shift in the Fed’s policy intentions. Previously, they had only stated that they were looking to move interest rates to what they considered to be a neutral level. Now, Powell openly admitted that the central bank was pursuing a restrictive policy—one designed to slow the economy. Although he clarified that causing a recession was not the Fed’s intent, history shows that the Fed is not great at engineering soft landings. Consumer confidence is already at all-time lows, and spending seems to be slowing down. Unemployment remains low, but inflation continues to give workers a pay cut in real terms and erode their purchasing power. A policy mistake is not an impossibility, and it will likely not take a big one to push the economy over the edge.

June 16, 2022