The Health Savings Account (HSA) is one of the most powerful investment vehicles. Not only is it the only account that offers triple tax savings at the federal level (if funds are used for qualified medical expenses). HSA funds can be used as an additional source of retirement funds after the age of 65. However, there are several restrictions to contributing to an HSA. This article will illustrate the triple tax advantage along with some other key benefits and establish some best practices for HSAs.

To enroll in and contribute to an HSA you need to participate in a High Deductible Health Plan (HDHP). The contribution limits for an HSA in 2020 is $7,100 for family coverage and $3,550 for individual coverage. There is also an additional $1K catch-up contribution for people over the age of 55. The minimum deductible for an HDHP is $1,400 for individuals and $2,800 for families in 2020. One thing to note is that if you are enrolled in an HDHP, you do not need earned income to contribute and there is no income phaseout. In that aspect, HSA restrictions are lighter than IRA limits. Contributions cannot be made once enrolled in Medicare, but HSA funds can be used to pay for Medicare part B, C, & D premiums plus co-payments or deductibles.

The triple tax advantage is the benefit of pre-tax contributions to lower your current tax, sheltering investment growth from tax, and allowing tax-free withdrawals for qualified medical expenses. An HSA contribution and growth may never be taxed if used properly. Though HSAs offer a triple tax advantage, many don’t utilize it to its full potential. Only 4% of HSAs are currently invested in the market1. Properly investing your HSA funds capitalizes on the tax growth shelter. Many HSA providers require a minimum balance of $1,000 in cash and then any excess funds can be invested in a selection of funds.

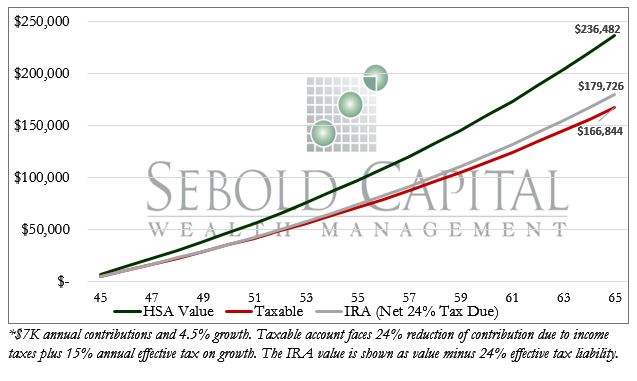

Below is a chart that shows how valuable 20 years of HSA contributions can be:

Best Practices

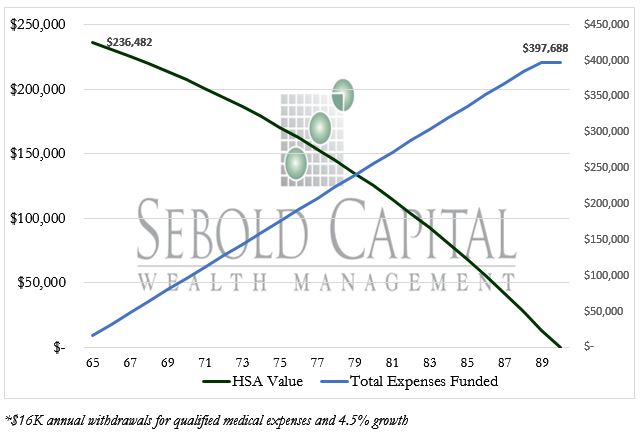

To maximize value from the HSA, you will want to make maximum contributions each year. However, you should not draw on those funds and instead continue to pay for medical expenses out of pocket. This may seem counterintuitive to why HSAs exist, but this maximizes tax efficiency. The longer the funds remain untouched, the more value they add. You should refrain from withdrawing until at least retirement. At this point, HSA should fund all out of pocket medical expenses. The $236K in the above example isn’t hard to use up, especially with rising health care costs and growing longevity.

After age 65, HSA funds can be withdrawn like traditional retirement funds for any purpose and taxed at your normal income tax rate. Any non-qualified withdrawals before age 65 are subject to income tax and a 20% penalty. The downside risk to accumulating wealth in an HSA is that a non-spouse beneficiary would lose the HSA status and the account value is taxable to them in the year you die.

In summation, HSA’s are one of the most attractive investment vehicles. Despite that, they are underutilized and often used inefficiently. There are even additional provisions like a one-time IRA transfer to HSA, funds for dependent’s medical expenses, funds for long term care premiums, etc. To maximize your HSA benefits and get it properly invested, please reach out to Sebold Capital.

1 Devenir Research https://www.devenir.com/research/2019-midyear-devenir-hsa-research-report

March 3, 2020