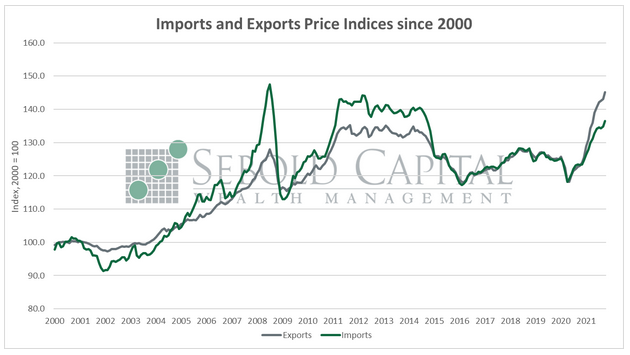

The import and export price indices measure changes in the prices of goods and services coming in and out of the United States. The data is used to deflate government trade statistics, predict future inflation and price changes, set fiscal and monetary policy, measure exchange rates, negotiate trade contracts, and identify specific industry and global trends. The indices are updated on a monthly basis and are provided by the Bureau of Labor Statistics’ (BLS).

The import and export price indices measure changes in the prices of goods and services coming in and out of the United States. The data is used to deflate government trade statistics, predict future inflation and price changes, set fiscal and monetary policy, measure exchange rates, negotiate trade contracts, and identify specific industry and global trends. The indices are updated on a monthly basis and are provided by the Bureau of Labor Statistics’ (BLS).

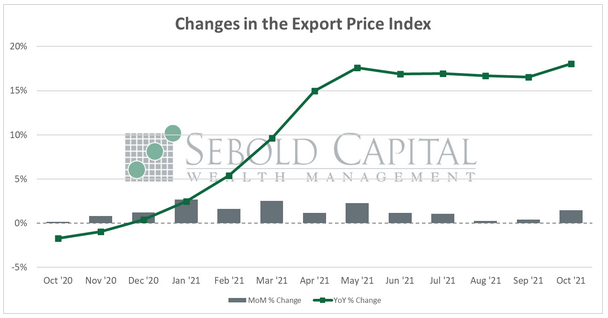

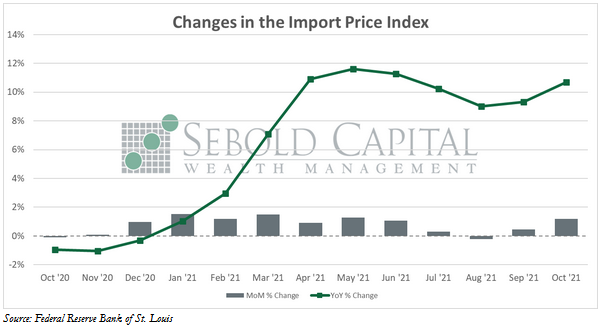

In October, export prices rose by 1.5% to an index level of 145.2. Prices for imports advanced by 1.2%, with the corresponding index increasing to 136.5. Export prices have soared by 18.0% on a year-over-year basis, while import prices have surged 10.7% over the same period.

Prices for imports and exports continued to rise last month, beating market expectations and increasing at the fastest pace since May. Prices for import fuel surged by 8.6% from the previous month and natural gas soared by an eye-watering 19.7%, while food and beverage prices increased by 0.8%. Meat prices alone rose by 5.6%, while another notable gain was the 1.1% increase in fish and shellfish prices. Meanwhile, agricultural export prices rose by 1%, while nonagricultural exports saw a more moderate advance but nonetheless contributed to the overall increase in the price level.

The imports and exports prices indices provide a more accurate reflection of the true extent of inflation for two reasons. For one, they are simple price indices; they just measure the change in prices over a certain period of time. They are not victims of geometric weighting or hedonic adjustments; they simply measure prices paid. The second reason is the current structure of the U.S. economy. Nowadays, the vast majority of goods that Americans consume are imported, therefore, an increase in import prices would likely result in a higher cost of living for consumers. Likewise, if export prices are increasing, that means that the domestic cost of those products is likely also rising, so consumers are paying higher prices either way. Looking at both of these indices, it seems that price pressures continue to build up—making them appear increasingly less transitory. All signs point to inflation that will persist well into next year, meaning consumers will continue to face higher prices for the foreseeable future.

November 17, 2021