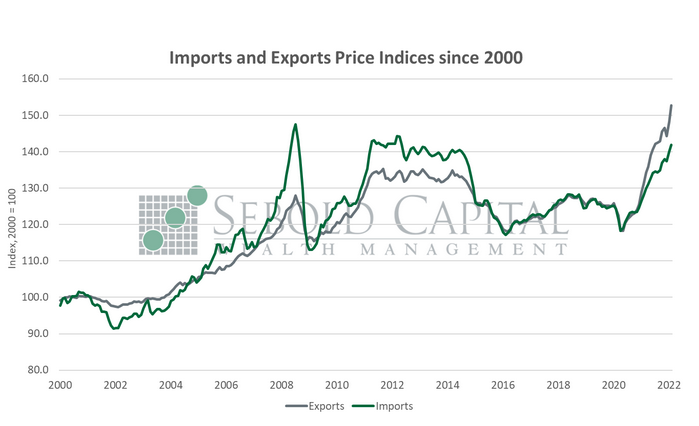

The import and export price indices measure changes in the prices of goods and services coming in and out of the United States. The data is used to deflate government trade statistics, predict future inflation and price changes, set fiscal and monetary policy, measure exchange rates, negotiate trade contracts, and identify specific industry and global trends. The indices are updated on a monthly basis and are provided by the Bureau of Labor Statistics’ (BLS).

The import and export price indices measure changes in the prices of goods and services coming in and out of the United States. The data is used to deflate government trade statistics, predict future inflation and price changes, set fiscal and monetary policy, measure exchange rates, negotiate trade contracts, and identify specific industry and global trends. The indices are updated on a monthly basis and are provided by the Bureau of Labor Statistics’ (BLS).

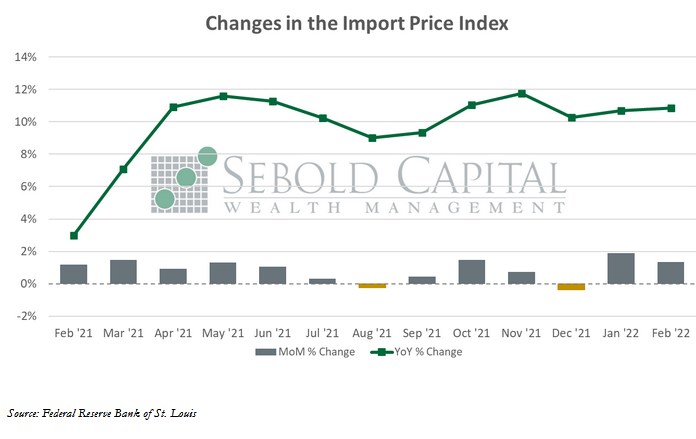

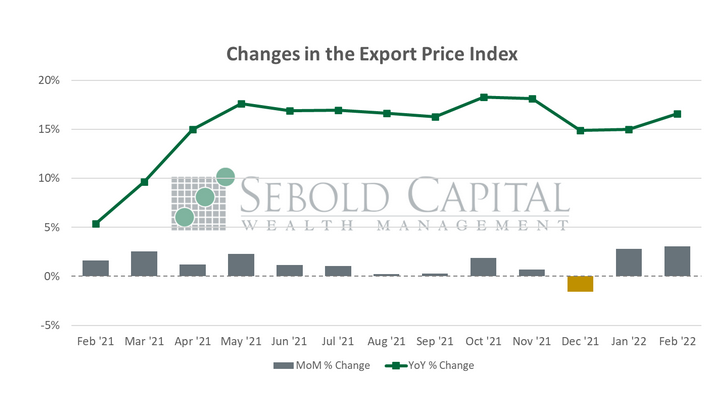

In February, export prices spiked by 3.0% to an index level of 152.7, well above market forecasts. Prices for imports advanced 1.4%, with the corresponding index increasing to 141.9. Export prices have soared by 16.6% on a year-over-year basis, while import prices have surged by 10.9% over the same period.

Prices for imports and exports continued to rise last month, reflecting the inflationary pressures that are present not only in the US, but also around the world. Export prices, in particular, are an excellent indicator of inflation at home as they reflect the rising cost of domestic production. Since the cost to produce for export should be the same as the cost to produce for domestic consumption, then it stands to reason that higher export prices translate to higher prices for US consumers. Import prices have been increasing at a slower pace than export prices, highlighting that the US is currently facing higher inflation than other parts of the world.

Unsurprisingly, fuel prices continued to lead the advance in import prices. Fuel prices had already surged by 7.7% in January and increased an additional 6.9% last month. Higher prices for oil more than offset a decline in natural gas prices for the month. Once again, this report does not capture the additional price pressures stemming from the war in Ukraine; those will begin showing up in the report for March. Non-fuel import prices advanced as well, rising by 0.8%, reflecting higher costs for industrial supplies, foods and beverages, capital goods, and automotive vehicles.

March 16, 2022