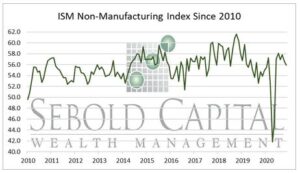

The ISM Services Purchasing Managers Index helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The nonmanufacturing sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80%; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50 indicate expansion while readings below 50 signal decline.

The ISM Services Purchasing Managers Index helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The nonmanufacturing sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80%; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50 indicate expansion while readings below 50 signal decline.

In November, the Services PMI fell by 0.7 percentage points to a reading of 55.9. This marks the sixth consecutive month of economic expansion as the index remains above 50 points. However, this month’s drop indicates that economic growth is continuing to slow down. The Supplier Deliveries Index, the only index in the report that is inversed (a reading above 50 indicates slower deliveries), is up 0.8 percentage points this month to a value of 57, which indicates strong consumer demand. Prices increased at a slightly faster rate, with its corresponding index rising 2.2 points to a reading of 66.1.

Most of the industries included in the index reported growth in November, the four exceptions being Arts, Entertainment & Recreation, Real Estate, Rental & Leasing, and Educational Services. Responses about business and economic conditions were mixed, with some companies struggling with logistics and capacity constraints. Likewise, most respondents said that they were being cautious while navigating operations amid the aftermath of the presidential election and the rising number of COVID-19 cases. The Employment Index rose 1.4 points to 51.5, with some businesses reporting a need to overstaff due to a high turnover rate and workers having to quarantine. Overall, the outlook for the service industry has not changed much from the last few months—demand is steady, but the pandemic continues to impact operations and supply chains. Businesses have largely adapted to the situation by this point, but they are not entirely immune to the circumstances.

December 3, 2020