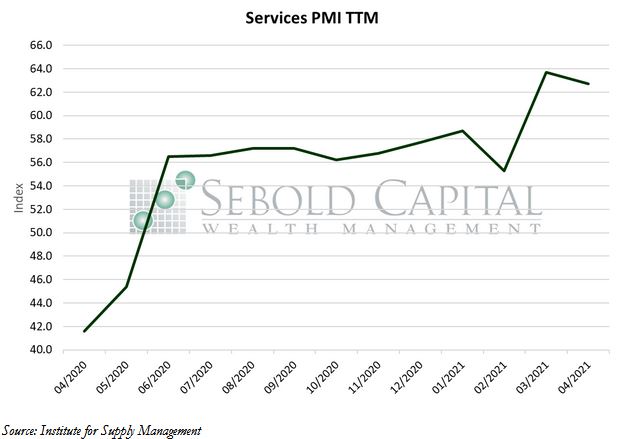

The ISM Services Purchasing Managers Index (PMI) helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50.0 indicate expansion while readings below 50.0 signal decline.

The ISM Services Purchasing Managers Index (PMI) helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50.0 indicate expansion while readings below 50.0 signal decline.

In April, the Services PMI decreased by 1.0 point to a reading of 62.7. This marks the eleventh consecutive month of growth for the services sector since the index remains considerably above 50. Seventeen out of the eighteen industries that make up the index reported growth last month, the one exception being the agriculture industry.

The index is made up of ten different sub-indexes which measure different aspects of the services sector. Six of these sub-indexes rose last month, while four declined. Business activity and production is expanding a slower rate, as are new orders being placed. However, order backlogs continue to grow and are doing so at a faster rate than before. Inventories are contracting, as indicated by their corresponding index, which is usually interpreted as a sign of rising demand in the near future. While the employment index rose last month, survey respondents are once again reporting difficulties finding and retaining labor—both skilled and unskilled. One industry, construction, even reported that this labor shortage is impacting their ability to accept all the work they would normally be able to if they were fully staffed. Expanded unemployment insurance benefits from the federal government have made it almost more profitable for some workers to be unemployed, so these challenges are likely to persist until the additional benefits expire, which is set to happen in September. Prices continue to rise, with the respective index rising by 2.8 points to 76.8—the highest since mid-2008. Concerns about inflationary pressure in the economy continue to grow as prices appear to be rising nearly across the board. Despite these challenges, most industries appear to be optimistic about business conditions in the near term. Consumer demand is rising as restrictions are eased and the number of vaccinated people increase. However, the aforementioned difficulties in finding labor, as well as logistics challenges, could undermine the ongoing economic recovery.

May 5, 2021