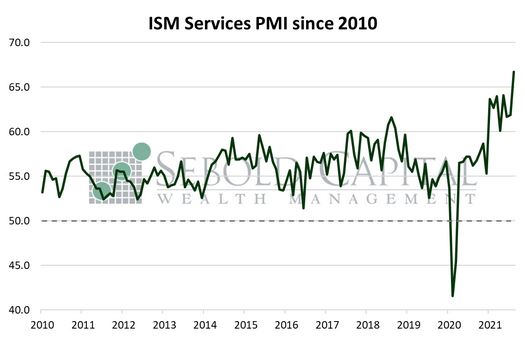

The ISM Services Purchasing Managers Index (PMI) helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50.0 indicate expansion while readings below 50.0 signal decline.

The ISM Services Purchasing Managers Index (PMI) helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50.0 indicate expansion while readings below 50.0 signal decline.

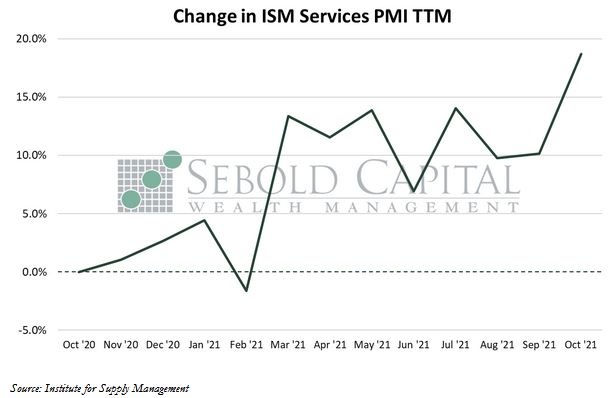

In October, the Services PMI rose 4.8 points to a level of 66.7, beating market expectations of 62.0 by a significant margin. This marks the seventeenth consecutive month of expansion for the services sector and for the overall economy. All of the eighteen industries that make up the index reported growth last month, however, the entire sector continues to face challenges that constrain capacity and impact industry conditions.

The index is composed of ten different sub-indexes that measure different aspects of the services sector. Seven of these sub-indexes advanced last month, while three declined. Both the Inventories and Inventory Sentiment sub-indexes declined, highlighting the impact of supply chain disruptions on firms. The Employment Index also declined as firms continue to struggle to fill positions, especially front-line. On the other hand, the Price Index surged by 7.0% to 82.9, its highest level since 2005. Prices paid by the service industry have soared by 29.1% year-to-date, and if the index is annualized, prices are on track to increase 35.9% in 2021. Despite the challenging business environment, rapidly rising prices, and hiring difficulties, firms continue to see relatively robust business activity. Given the current inventory levels, demand is likely to remain strong in the near term, barring any shocks to the industry or the overall economy.

November 4, 2021