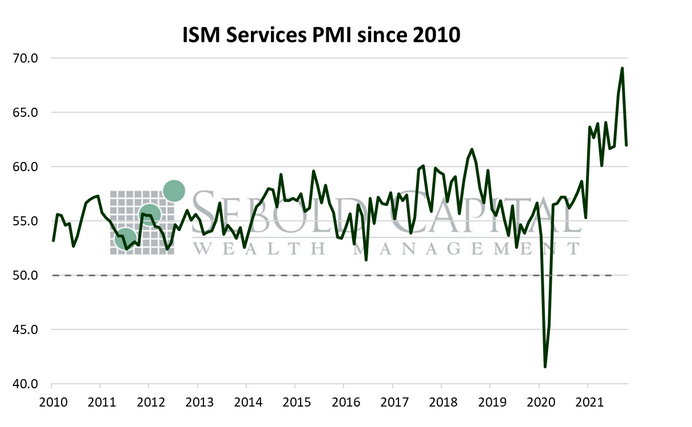

The ISM Services Purchasing Managers Index (PMI) helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50.0 indicate expansion while readings below 50.0 signal decline.

The ISM Services Purchasing Managers Index (PMI) helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50.0 indicate expansion while readings below 50.0 signal decline.

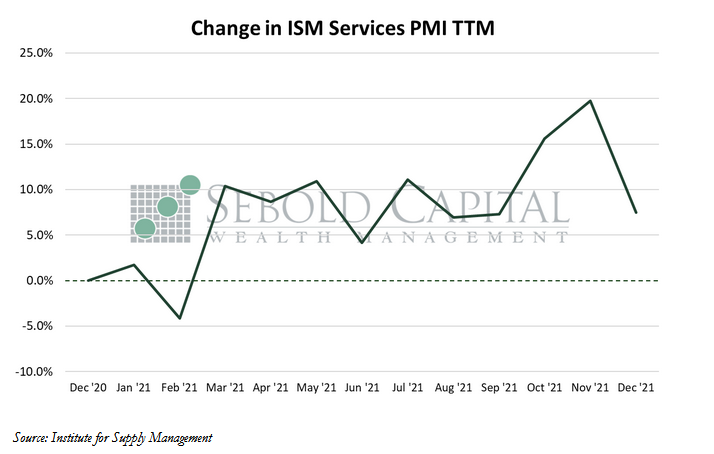

In December, the Services PMI declined by 7.1 points to a level of 62.0, coming in well below of market expectations of 67.5 and retreating from the all-time high of 69.1 it reached in November. Nevertheless, this marks the nineteenth consecutive month of growth for the services sector and for the economy as a whole. Only one of the eighteen industries that make up the report saw a contraction last month, that being Mining, with the rest of the industries reporting moderate to strong growth.

The index is composed of ten different sub-indexes that measure different aspects of the services sector. Six of these sub-indexes declined last month, many of them retreating from record-highs. Business activity and new orders decreased, although the index that measures new export orders rose. The Employment sub-index declined as firms continued to report labor shortages and higher-than-normal employee attrition. The Prices Paid index rose last month after briefly retreating from the all-time high it reached in October. Saying it retreated, however, might be bit of a stretch since it went from 82.9 in October to 82.3 in November. In any case, the Prices Paid index rose to 82.5 in December, its second-highest reading ever. The index rose by 28.5% in 2021, reflecting the persistent price pressures faced by producers and firms alike. Several respondents of the survey noted that there is still plenty of room for price increases since many of their suppliers have yet to pass on their own higher costs. Some report shipping costs as the main source of price pressures, resulting from higher fuel costs and capacity constraints. These price pressures will likely continue to trickle down the supply chain until they eventually make their way to consumers, pushing consumer prices even higher in 2022.

January 6, 2022