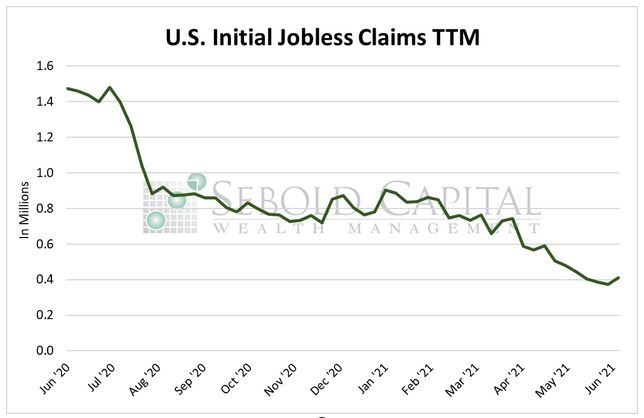

US Initial Jobless Claims, provided by the US Department of Labor, provides underlying data on how many new people have filed for unemployment benefits in the previous week. One can gauge market conditions in the US economy around employment; as more new individuals file for unemployment benefits, fewer individuals in the economy have jobs. In normal times, this means people have less money to spend. Historically, initial jobless claims tended to reach peaks towards the end of recessionary periods, such as on March 21, 2009, when 661,000 new filings were reported.

US Initial Jobless Claims, provided by the US Department of Labor, provides underlying data on how many new people have filed for unemployment benefits in the previous week. One can gauge market conditions in the US economy around employment; as more new individuals file for unemployment benefits, fewer individuals in the economy have jobs. In normal times, this means people have less money to spend. Historically, initial jobless claims tended to reach peaks towards the end of recessionary periods, such as on March 21, 2009, when 661,000 new filings were reported.

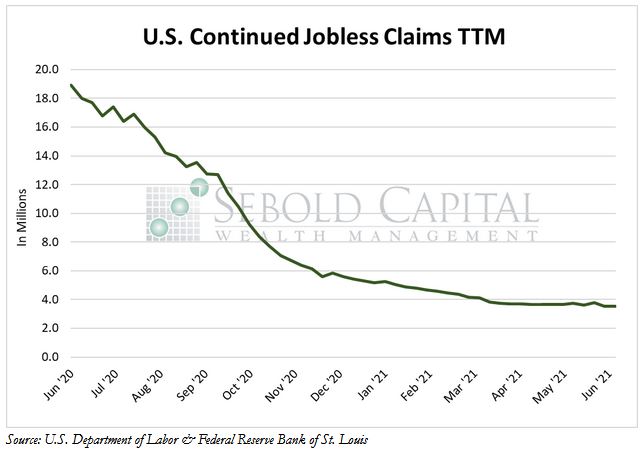

Last week, initial claims rose above 400,000 again after briefly dropping below that benchmark in late May and early June. The number of claims increased by 9.8% to 412,000, the highest level in a month. The number of continued claims also rose slightly last week, advancing by 0.03% to 3.52 million. The number of initial claims remains above its long-run average of 372,000 and the number of continued claims still sits considerably above its long-run average of 2.81 million.

Initial claims rose once again last week right after reaching a new pandemic low the prior week. The figure managed to beat market estimates by a considerable margin, with most predictions hovering around 360,000. The uptick in unemployment insurance claims comes at an interesting time, as several sates have ended the additional UI benefits that at least partly responsible for the ongoing labor shortage. While the full effect of ending the additional benefits may not be felt immediately on the labor market, states that have recently enacted this measure saw claims decline last week. Alaska, Mississippi, and Missouri—all of which have opted out of enhanced benefits—saw a drop in claims last week. By contrast, California, Kentucky, and Pennsylvania—which will continue to offer the $300 a week until they expire in September—led the recent increase in claims.

The additional UI benefits may admittedly not be only factor contributing to the current slack in the labor market. However, essentially paying people not to work has undoubtedly had a significant impact on the rate at which people return to work. Job openings recently rose to a record-high, indicating a strong demand for labor, while hiring has remained relatively flat—usually falling below market estimates. There is likely a large number of people who are choosing to not go back to work, as the government benefits make it more profitable for many of them to be unemployed. Until the benefits expire, unemployment is likely to remain elevated at a nationwide level, and more so in states that continue to be a part of the program.

June 17, 2021