The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

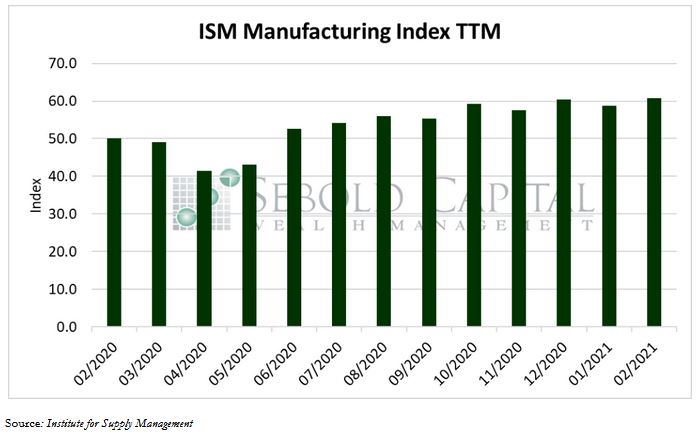

In February, the Manufacturing PMI rose by 2.1 percentage points to a reading of 60.8 from January’s reading of 58.7. This marks the tenth consecutive month in which the manufacturing sector has expanded at an above-average rate. Out of the six largest industries surveyed, five reported strong growth last month, the one exception being Petroleum & Coal products.

The Manufacturing Index is comprised of several sub-indexes that are all equally weighted when factored into the value of the index. Nearly every index increased last month, aside from the ones measuring Inventories and Imports. The indices measuring orders increased substantially in February, with New Orders rising by 3.7 points to 64.8, Backlog of Orders surged by 4.3 points to 64.0, and New Export Orders increased by 2.3 points to 57.2. The Production index rose by 3.7 points to a level of 64.8, while the Supplier Deliveries index grew by 3.8 points to a reading of 72.0. The employment outlook for the industry also improved last month, with its corresponding index increasing by 1.8 points to 54.4. However, several respondents continue to report labor shortages—a trend that has been ongoing for several months now. Both supplier and consumer’s inventories continue to contract, a sign that demand is rising.

While the manufacturing industry posted strong growth last month, concerns regarding prices are growing. The index that measures prices increased by 3.9 points and currently sits at 86.0—the highest reading since May 2008. The cost of raw materials has been on the rise for the past nine months, partly due to shortages, supply chain disruptions, and growing demand. A global semiconductor shortage, in particular, has impacted production for many automobile manufacturers. February’s severe winter weather also temporarily disrupted several supply chains. Last month’s surge in prices correlates with expectations that inflation will accelerate in the near future.

March 1, 2021